Time Value of Money — Six Functions of a Dollar

Lesson 3 — Present Worth of $1

Appraisal Training: Self-Paced Online Learning Session

This lesson discusses the Present Worth of $1 (PW$1); one of six compound interest functions presented in Assessors' Handbook Section 505 (AH 505), Capitalization Formulas and Tables. The Lesson:

- Explains the function's meaning and purpose

- Provides the formula for the calculation of PW$1 factor

- Shows how to calculate the present value of multiple payments

- Contains practical examples of how to apply the PW$1 factor

PW$1: Meaning and Purpose

The PW$1 factor is the amount that must be deposited today to grow to $1 in the future, given periodic interest rate i and n periods.

The PW$1 factor is used to discount a single future amount to its present amount. The PW$1 factors are in column 4 of AH 505 (opens in a new tab).

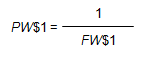

The PW$1 factor can be thought of as the opposite of the FW$1 factor; mathematically, the PW$1 and FW$1 factors are reciprocals:

Whereas the FW$1, discussed in Lesson 1, provides the future value of a single present amount, the PW$1 provides the present value of a single future amount.

The value of the PW$1 factor will always be less than $1, explicitly demonstrating that a dollar to be received in the future is worth less than a dollar today.

Formula for Calculating PW$1 Factors

The formula for the calculation of the PW$1 factors is:

Where:

- PW$1 = Present Worth of $1 Factor

- i = Periodic Interest Rate, often expressed as an annual percentage rate

- n = Number of Periods, often expressed in years

In order to calculate the PW$1 factor for 4 years at an annual interest rate of 6%, use the formula below:

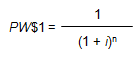

Viewed on a timeline:

A depositor would be willing to give up $0.792094 today (shown as negative on the timeline) in order to receive $1 at the end of 4 years (shown as positive).

To locate the factor, go to AH 505, page 33 (opens in a new tab), go down 4 years, and then across to column 4. The correct PW$1 factor is 0.792094.

Practical Applications of PW$1

Example 1:

How much must be deposited today in order to have $15,000 at the end of 10 years, assuming an annual interest rate of 7% with annual compounding?

Solution:

- PV = FV × PW$1 (7%, 10 yrs, annual)

- PV = $15,000 × 0.508349

- PV = $7,625

- Find the annual PW$1 factor (annual compounding) for 7% at a term of 10 years. In AH 505, page 37 (opens in a new tab), go down 10 years and across to column 4 to find the correct factor of 0.508349.

- The present value of $7,625 is equal to the future value of $15,000 multiplied by the factor.

Example 2:

Someone promises to pay you $25,000 in 5 years. Given an annual interest rate of 6% with annual compounding, how much should you pay for this promise today?

Solution:

- PV = FV × PW$1 (6%, 5 yrs, annual)

- PV = $25,000 × 0.747258

- PV = $18,681

- Find the annual PW$1 factor (annual compounding) for 6% at a term of 5 years. In AH 505, page 33 (opens in a new tab), go down 5 years and across to column 4 to find the correct factor of 0.747258.

- The present value of $18,681 is equal to the future value of $25,000 multiplied by the factor.

Example 3:

If you want to have $10,000 after 3 years, and you can invest at an annual rate of 5% compounded annually, how much should you invest today?

Solution:

- PV = FV × PW$1 (5%, 3 yrs, annual)

- PV = $10,000 × 0.863838

- PV = $8,638

- Find the annual PW$1 factor (annual compounding) for 5% at a term of 3 years. In AH 505, page 29 (opens in a new tab), go down 3 years and across to column 4 to find the correct factor of 0.863838.

- The present value of $8,638 is equal to the future value of $10,000 multiplied by the factor.

Example 4:

Ten years from now, you will need to make a lump-sum payment of $500,000. Assuming annual compounding, how much should you invest today in order to cover the future payment? The annual interest rate is 10%.

Solution:

- PV = FV × PW$1 (10%, 10 yrs, annual)

- PV = $500,000 × .385543

- PV = $192,772

- Find the annual PW$1 factor (annual compounding) for 10% at a term of 10 years. In AH 505, page 49 (opens in a new tab), go down 10 years and across to column 4 to find the correct factor of 0.385543.

- The present value of $192,772 is equal to the future value of $500,000 multiplied by the factor.

Example 5:

Acme Enterprises promises to pay the holders of its most recent bond issue $1,000 per bond at the end of 25 years (there are no annual or semi–annual interest payments; this is called a “zero coupon” bond). If the annual interest rate is 8.50%, assuming annual compounding, how much should each bond sell for when issued?

Solution:

- PV = FV × PW$1 (8.50%, 25 yrs, annual)

- PV = $1,000 × 0.130094

- PV = $130.09

- Find the annual PW$1 factor (annual compounding) for 8.50% at a term of 25 years. In AH 505, page 43 (opens in a new tab), go down 25 years and across to column 4 to find the correct factor of 0.130094.

- The present value of $130.09 is equal to the future value of $1,000 multiplied by the factor. The bond should sell for $130.09.

Multiple Payments and PW$1

We have calculated the present value of single amounts or payments, using the PW$1 factors.

Many problems involve more than one payment, making it necessary to calculate the present value of multiple payments–that is, the present value of a stream of payments. Determining the present value of multiple payments is a straightforward extension of the single-payment situation.

When we calculated the present value of a single future payment, we multiplied the future payment by the appropriate PW$1 factor. This discounted the future payment to its present value.

If there is more than one future payment, multiple each payment by the appropriate PW$1 factor and add the present values. The sum of the present values is the total present value of the stream of future payments.

Practical Applications of PW$1 with Multiple Payments

Example 1:

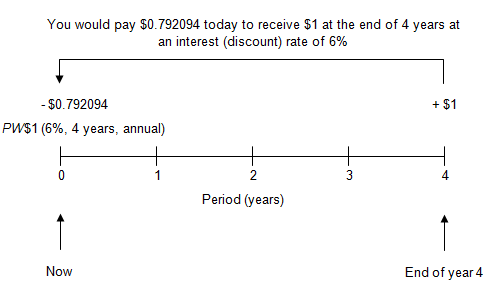

Consider the following 3 payments:

- $10,000 at the end of the first year

- $15,000 at the end of the second year

- $20,000 at the end of the third year

At an annual interest rate of 5%, what is the total present value of the 3 payments?

Solution:

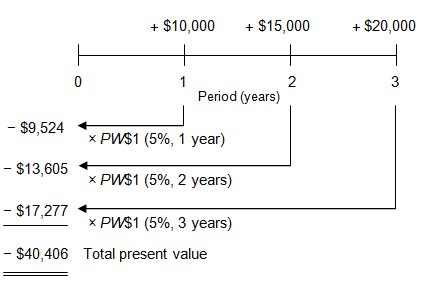

Calculate the present value of each payment using the PW$1 factors and add those present values. The sum is the present value of all 3 payments. (AH 505, page 29 [opens in a new tab])

Thus:

| Payment | PW$1 Factor | Present Value |

|---|---|---|

| $20,000 × | 0.863838 (PW$1, 5%, 3 years) = | $17,277 |

| $15,000 × | 0.907029 (PW$1, 5%, 2 years) = | $13,605 |

| $10,000 × | 0.952381 (PW$1, 5%, 1 year) = | $9,524 |

| Total = | $40,406 | |

| Years | Future Worth of 1 | Future Worth of 1 per Period | Sinking Fund Factor | Note this text.Present Worth of 1 | Present Worth of 1 per Period | Periodic Repayment |

|---|---|---|---|---|---|---|

| Note this value.1 | 1.050000 | 1.000000 | 1.000000 | Note this value.0.952381 | 0.952381 | 1.050000 |

| Note this value.2 | 1.102500 | 2.050000 | 0.487805 | Note this value.0.907029 | 1.859410 | 0.537805 |

| Note this value.3 | 1.157625 | 3.152500 | 0.317209 | Note this value.0.863838 | 2.723248 | 0.367209 |

| 4 | 1.215506 | 4.310125 | 0.232012 | 0.822702 | 3.545951 | 0.282012 |

| 5 | 1.276282 | 5.525631 | 0.180975 | 0.783526 | 4.329477 | 0.230975 |

Viewed on a timeline:

A person would be willing to pay $40,406 now (shown as negative on the timeline) in order to receive the three future payments of $10,000, and $15,000, and $20,000 (shown as positive).