Lesson 6 — Characteristics of the Income Stream (The Income Approach to Value)

Appraisal Training: Self-Paced Online Learning Session

In the beginning of Lesson 5, we discussed the definition of the income approach to value and the definition of an income stream. This lesson discusses the following:

- Components of the Income Stream

- Shapes of the Income Stream

Components of the Income Stream

When investors purchase property for its future income, they anticipate that the future income from the property will satisfy several different functions. Therefore, the income stream can be separated into several components: (1) a component to provide for all property related expenses, including vacancy and collection losses, maintenance and repair, and utilities; (2) a component to provide for the payment of the property taxes on the property; (3) a component to allow for the return OF the investment (investment recapture); and (4) a component to allow for a return ON the investment (investment yield), even if this return ON or yield is not realized until the property is resold.

Vacancy and Collection Loss

Typically, an investor will anticipate that the property will experience some vacancy or collection losses during the remaining economic life of the property. Vacancy and rent collection loss is an allowance for reductions in gross income attributable to vacancies, tenant turnover, and nonpayment of rent. Even when a property has a history of no vacancy and collection loss, it is prudent to anticipate that a loss will occur at some point in the future. Vacancy and collection losses are usually expressed as a percentage of potential gross income. Potential gross income is the total income attributable to property at full occupancy before vacancy and collection loss allowances and operating expenses are deducted. Property Tax Rule 8 of Title 18, California Code of Regulations, refers to potential gross income as “gross return.”

Property Expenses

An investor will also anticipate that the income stream will be sufficient to allow for all property related expenses. Property expenses are those operating expenses that are necessary to maintain or insure an income stream — that is, maintain a flow of income to the property. It may be useful — to insure that all, and only, valid operating expenses are considered, to think of three broad categories of expenses:

- fixed (such as building insurance and taxes, but see the discussion of property taxes, below),

- variable (such as management, maintenance, repairs, and utilities), and

- reserves for replacements (allowances for the replacement of structure components, such as roofs, equipment, and paint — usually major items that will have to be replaced periodically during the life of the structure).

Operating expenses may be expressed either as a percentage of the effective gross income or as line item (lump sum) expenses. Expenses are discussed in detail in Lesson 7.

Property Taxes

The investor will anticipate that he or she will have to pay property taxes based on the taxable value of the property. Therefore, the income stream should be sufficient to allow for the payment of the annual property tax. (During the rate derivation and valuation process, ad valorem property taxes are handled pursuant to subsections (c) and (f) of Property Tax Rule 8.)

Return OF Investment

The investor will anticipate that the income stream should allow for a return OF their investment. Return OF the investment is the recovery of invested capital, usually through income payments and the reversion. The return OF the investment may be called recapture of the investment or capital recapture. Allowance for recapture can be accounted for in a variety of methods: sinking fund recapture, straight-line recapture, or sale of the property.

Return ON Investment

An investor will anticipate a profit on the investment in the property — a return on the investment. The return ON the investment is the additional amount received as compensation for use of an investor's capital until it is recaptured. The rate of return on the investment is equivalent to the interest rate that is earned or is expected to be earned. The interest rate is the profit that is realized by the investor. The investor may receive a return ON the investment over a period of time or may not realize any profit until the property is resold. In either case, people generally will not invest in property that will not produce a return ON the investment.

The components of the income stream will be discussed in more detail in Lesson 7 (Processing the Income Stream and Anticipated & Economic Income and Expenses).

Depreciation and Mortgage Payments

Property related expenses do NOT include book depreciation and mortgage payments — these are related to how the property is owned — they are not related to the operation of the property.

Shapes of the Income Stream

An income stream is a steady flow of benefits (income) from an investment over a period of time (holding period). A holding period is the time span or term of ownership of an investment. Income streams can be represented by one year's worth of income or by a series of incomes over a period of years. The shape of the income stream can represent the flow of income. Income streams can remain constant (level), increase, decrease, terminate at a certain point in time, or can flow into perpetuity.

The various shapes of income streams can be categorized into five major groups:

1. Constant Perpetual Income Stream

A constant perpetual income stream is a series of equal periodic income payments that are received regularly over a period of time; they may be either annual or monthly. The assumption is that the payments will continue into perpetuity. This shape of income is usually associated with vacant land — in theory, land is a non-wasting asset, and, as such, there is no need to allow for a return OF the investment. Therefore, land is considered to be capable of producing a constant perpetual income. A constant perpetual income stream shape would look like the graph below. The infinity sign and arrow in the graph depict the income stream going into perpetuity.

This untitled plot is a line graph. The x axis is time and the y axis is income. There are no increments shown. A line extends from a random point on the income axis and moves across the time axis to infinity. The space under the line is filled in, representing a steady, consistant flow of income.

This untitled plot is a line graph. The x axis is time and the y axis is income. There are no increments shown. A line extends from a random point on the income axis and moves across the time axis to infinity. The space under the line is filled in, representing a steady, consistant flow of income.

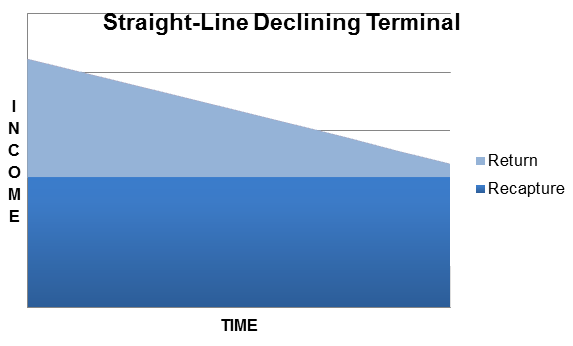

2. Straight Line Declining Terminal

A straight-line declining terminal income stream is a series of annual incomes that decline in equal amounts over a period of time until the wasting asset has no value, at which time the income attributable to the wasting asset terminates. A graph depicting a straight line declining terminal income stream is illustrated in below.

This line graph is titled Straight-Line Declining Terminal. It has Time as the x axis and Income as the y axis. There is a legend on the right that describes the red region on the plot as Return and the blue region as Recapture. There is a line that starts high on the income axis and decreases as it moves further along the time axis. Directly under the line, the fill is red for Return. Underneath the red region is a blue region, Recapture, starts lower than the line and stays the same height as it moves across the time axis.

This line graph is titled Straight-Line Declining Terminal. It has Time as the x axis and Income as the y axis. There is a legend on the right that describes the red region on the plot as Return and the blue region as Recapture. There is a line that starts high on the income axis and decreases as it moves further along the time axis. Directly under the line, the fill is red for Return. Underneath the red region is a blue region, Recapture, starts lower than the line and stays the same height as it moves across the time axis.

Recapture OF the investment is allowed through a procedure that is based on straight-line recapture; in other words, an equal amount of recapture of the investment is made each year, while the return ON the investment decreases annually. The illustration above depicts equal amounts of recapture per period, with a declining income, and declining return on investment.

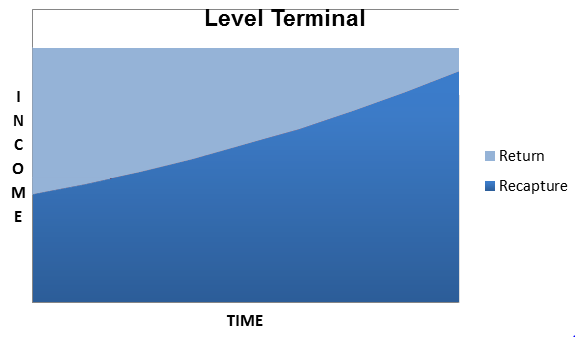

3. Level Terminal Income Stream (ALSO KNOWN AS Constant Terminal or Level Annuity)

A level terminal income stream is a series of equal, annual incomes that terminate at some point in the future. Terminal income streams are normally associated with wasting assets (improvements). A graph depicting a constant terminal income stream is illustrated in below.

This line graph is titled Level Terminal. It has Time as the x axis and Income as the y axis. There is a legend on the right that describes the red region on the plot as Return and the blue region as Recapture. There is a curved line that starts low on the income axis and increases as it moves along the time axis. The red region, Return, fills the space above the curve while the blue region, Recapture, fills the space below the curve.

This line graph is titled Level Terminal. It has Time as the x axis and Income as the y axis. There is a legend on the right that describes the red region on the plot as Return and the blue region as Recapture. There is a curved line that starts low on the income axis and increases as it moves along the time axis. The red region, Return, fills the space above the curve while the blue region, Recapture, fills the space below the curve.

Return OF the investment is allowed for through a procedure that is based on a sinking fund recapture. The return ON investment (the interest paid) increases annually over the holding period. The graph above depicts what portion of the payments is return OF investment and which is return ON investment.

4. Variable Income Stream

A variable income stream is a series of annual incomes that fluctuate in amounts from year to year. Notice in the graph below that the income stream can be either a positive or a negative sum. Return OF the investment may be allowed through a variety of methods or the entire investment may be recaptured when the property is sold. The same is true for the return ON the investment. Examples of income that may have this type of shape include seasonal businesses affected by such elements as holidays, vacation, weather, and harvesting).

This line graph is untitled. It has Time as the x axis and Income as the y axis. It shows a step function, with each year's income displayed as a whole. Throughout the graph, the area between the line and the time axis is filled, representing the income for the year. The line begins underneath the time line, representing a negative income for the first year. As the function moves across the time axis, it has values both above and below the time axis, representing both positive and negative incomes.

This line graph is untitled. It has Time as the x axis and Income as the y axis. It shows a step function, with each year's income displayed as a whole. Throughout the graph, the area between the line and the time axis is filled, representing the income for the year. The line begins underneath the time line, representing a negative income for the first year. As the function moves across the time axis, it has values both above and below the time axis, representing both positive and negative incomes.

5. Reversion Income

Reversion is a lump sum payment that an investor receives or expects to receive at some point in time in the future. It is usually associated with the termination of an investment. Examples of this type of income stream include a balloon payment on a loan or the salvage value of personal property.

This line graph is untitled. It has Time as the x axis and Income as the y axis. It shows a step function, with each year's income displayed as a whole. Most of the line falls at 0 income as it moves across the time axis. Towards the end of the plot, there is one large step in income, filled underneath the line, showing a positive income for the only that single year.

This line graph is untitled. It has Time as the x axis and Income as the y axis. It shows a step function, with each year's income displayed as a whole. Most of the line falls at 0 income as it moves across the time axis. Towards the end of the plot, there is one large step in income, filled underneath the line, showing a positive income for the only that single year.

A property may have several types of income streams associated with it. For example, the underlying land of a building will have a constant perpetual income stream, the improvement on the property may have a constant terminal income stream, and the investor may receive a reversion income at the end of the holding period.

Summary

The lesson you just read discussed the components of the income stream and the various shapes of income streams. The next lesson will discuss the steps necessary to process an income stream.

Note: Before proceeding on to the next lesson, be sure to complete the exercises for this lesson.