Lesson 13 – Derivation of Yield Rates (The Income Approach to Value)

Appraisal Training: Self-Paced Online Learning Session

In Lesson 8 through 11, we discussed various methods of converting income into value – capitalization – and learned about deriving and using capitalization rates for direct capitalization. That is, we learned to convert an estimate of a single year's income expectancy, or an annual average of several years' income expectancies, into an indication of value in one direct step.

The conversion was either done by multiplying the income estimate by an appropriate multiplier or by dividing the income estimate by an appropriate capitalization rate. We discussed the differences between the return OF the investment and the return ON the investment, but when we capitalized income into value we made no distinction between the return OF and the return ON an investment.

These two elements, return ON and return OF, were lumped together, in one multiplier or one OverAll Rate. Moreover, the appraiser was cautioned that there was no way of adjusting an OverAll Rate for dissimilarities of location, risk, size, age, Remaining Economic Life, and tax advantages. Therefore the properties used to derive rates and multipliers need to be very comparable to the property (ies) being appraised.

This lesson discusses the following:

- Commonly Applied Capitalization Rates

- Relationship between Income Rates and Yield Rates

- Derivation of Yield Rates

Commonly Applied Capitalization Rates

A capitalization rate is any rate used for the conversion of net income into value. Although there are several types of capitalization rates used in appraisal, they can be classified as either income rates or yield rates.

Income Rates

An income rate is a rate that reflects the ratio of one year's income to the value of a property. The overall capitalization rate, mortgage constant rate, and the equity rate are income rates. These rates are also known as cash flow rates.

Overall capitalization rates [Ro] are income rates used to value the total property. The Ro represents a relationship between a single year's income and the value of the property. The Ro derived from a property implicitly reflects the investment's income pattern, value change equity build-up, income tax benefits, and yield rate. Even though the items just mentioned are implied, individually they cannot be calculated. Ro plus the tax rate is used to convert a single year's net income before recapture and taxes into an indication of the total property value.

The mortgage capitalization rate [Rm], or mortgage constant [MC or ƒ], is another income rate. The Rm represents the relationship between a single year's debt services to the principal amount of the loan. That is, it represents the value of the debt interest in a property. In Lesson 11 the Rm was used in the band-of-investment technique to derive an OverAll Rate [Ro].

Equity capitalization rates [Re] are income rates that represent the equity portion within an investment. The Re represents a relationship between a single year's pre-tax cash flow (net income before recapture minus an annual debt service) and the value of the equity interest in a property. The Re is used in the band-of-investment technique to derive a Ro.

Yield Rates

A yield rate is a rate of return on capital; it is usually expressed as a compound annual percentage rate. A yield rate considers all expected benefits from the property over the income projection period, including both annual net income and any remaining value or sale proceeds, at the termination of the investment. This remaining value is referred to as the reversion, reversionary interest, or terminal value. When a yield rate is used in yield capitalization to discount future income payments into a value indicator, it is also referred to as a discount rate. In appraisal, the terms yield rate and discount rate are virtually synonymous. Although a yield rate, per se, includes only the return on capital, in the capitalization process, yield rates are usually used in conjunction with a corresponding compound interest or annuity factors that explicitly provide for the return of investment or capital recovery.

The overall yield rate (Yo) is the required rate of return on the total amount of invested capital, including both debt and equity. The Yo is used to discount the annual net income, taking into consideration changes in net income over the investment period, and any income derived from the reversion into an indicator of total property value. The Yo is also called the property yield rate.

The equity yield rate (Ye) is the required rate of return on equity capital. The Ye is used to discount the annual net income attributable to the equity interest and the equity reversion into an indicator of value for the equity interest only. It is the equity investor's internal rate of return.

Also referred to as the effective interest rate (i), the yield rate on the mortgage (Ym) is the required rate of return on debt capital; it is the amount paid, expressed as a percentage per month or year, for the use of borrowed money. It is the rate at which mortgage payments can be discounted into the present value of the mortgage. Ye and Ym are also used in the band of investment technique to derive a Yo.

An internal rate of return (IRR) is the annualized rate of return (yield) on invested capital that is generated or is capable of being generated within an investment over a period of ownership. It is a specific rate that will discount a buyer's anticipated income, including the income at the termination of the investment, to the present value of the property. The IRR is used to derive a yield rate from sales data.

Relationship between Income Rates and Yield Rates

An investment in a property that is expected to decrease in value will have an income rate that is larger than the yield rate. An investment in a property that is expected to increase in value will have an income rate that is smaller than the yield rate. When the investment is in a property that is not expected to change in value, the income rate will be equal to the yield rate.

Derivation of Yield Rates

Under some situations, the anticipated income stream can be processed to a level from which an anticipated yield rate can be derived from a sale. A yield rate is a rate of return on capital. It is usually expressed as a compound annual percentage rate. The yield rate is that portion of the income stream that is remaining after vacancy and collection losses and all expenses, including anticipated taxes and allowances for recapture are deducted from the anticipated gross income. It represents the anticipated or hoped for rate of return on an investment in property. An investor may receive yield over a period of time, at the resale of the property, or a combination of both.

A yield rate is a measure of investment return that can be used to discount a single year's income stream or a series of income streams. Yield rates are computed based on the yield over a period of time that an investor typically holds an investment property. The time period may be the remaining economic life of the improvements, but it is generally a shorter period.

Yield rates can be derived from sold properties using direct capitalization techniques. However, yield rates can only be derived from a single year's income when the income stream is projected to be either straight-line declining terminal or level (constant) terminal. If either of these income streams is projected, a yield rate can be determined using a short-cut method.

Remember, when extracting a rate from a sale, you are comparing the income (and expenses) the purchaser anticipated at the time of the purchase, with the purchaser's estimate of the property's value. R = I ÷ V = anticipated Income ÷ purchase price. (We use market – economic – income and expenses to value property, because we are after market value, but when deriving rates and multipliers we are comparing the income anticipated by the buyer with the buyer's estimate of value.)

Deriving a Yield Rate for a Straight-Line Declining Terminal Income Stream

A straight-line declining terminal income stream is a series of annual incomes that decline in equal amounts over a time period until the income of a wasting asset terminates.

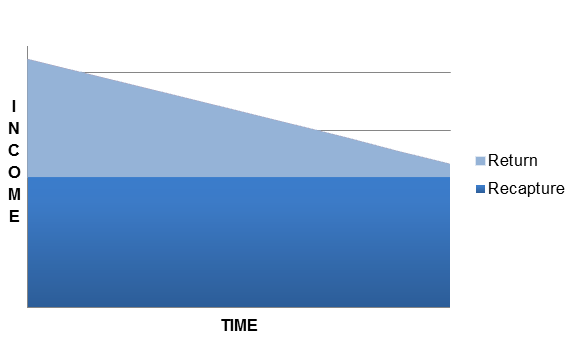

Market derivation of a yield rate using a straight-line declining terminal income premise is performed whenever the market recognizes this method of recapture. Recapture is in equal annual payments, and the net income before recapture decreases in equal annual amounts.

One year's income stream, usually the first year, is processed to a level of Net Income Before deducting for Recapture [NIBR]. Subtracting an allowance for annual recapture from the NIBR leaves a residual income that is yield income.

The allowance for recapture is calculated by multiplying the value of the improvements (overall value less land value) by a recapture rate. The recapture rate is normally called the Capital Recapture Rate [CRR].

Improvement Value × CRR = Allowance for Recapture

For straight-declining terminal income streams, a CRR is the result of dividing the number one by the Remaining Economic Life [REL] of the improvements. Remaining Economic Life is the estimated period during which improvements will continue to contribute to the property's value. It is that period of time in which the combination of the land and improvements will produce an income that is greater than the income that the land alone could produce.

As an alternative, the above two formulas can be combined to look like this:

(Overall Value − Land Value) ÷ REL = Allowance for Recapture

Lastly, dividing the current year's anticipated net income (derived by subtracting anticipated recapture from the anticipated NIBR) by the sale price gives an indication of the investor's anticipated rate of return on the investment.

The presumption that value and income will decline steadily is frequently inconsistent with the market behavior; nevertheless, the procedure has important uses. Straight-line declining recapture is not appropriate for valuing an investment in land or other asset that can sustain value indefinitely.

The information needed to process a yield rate for a straight line declining income stream is:

- Anticipated gross income

- Anticipated vacancy and collection loss

- Anticipated expenses (or expense ratio)

- Anticipated property taxes

- Estimate of improvement value

- Estimate of improvement's remaining economic life

- Sales price

EXAMPLE 13-1: Deriving a Yield Rate for a Straight Line Declining Terminal Income Stream

We are going to continue with the apartment complex we started in Example 11-1. This was the 20-unit apartment complex that recently sold for $850,000. The current contracted rent was $525 per unit. The buyers stated that they anticipated a 5 percent vacancy and collection loss. The operating expenses totaled $29,550. We processed the income stream as follows:

The buyers also state that they believe the apartment complex has a 40 year remaining economic life, and of the $850,000 purchase price, they feel that the land is worth $125,000.

Assuming a straight-line declining terminal income, the investor's anticipated return on the investment can be calculated as follows:

Deriving a Yield Rate for a Level (Constant) Terminal Income Stream

A level (constant) terminal income stream is a series of equal, annual incomes that terminate at some point in the future.

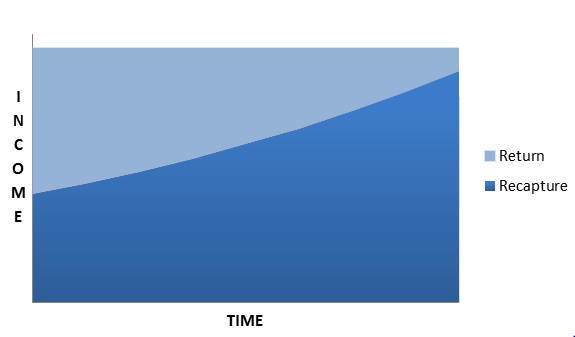

The determination of the yield rate becomes more complicated when the income stream is projected to be a level (constant) terminal income (also known as level terminal income or level annuity income). The derivation of an indicated yield rate for the level terminal income is a trial and error technique because two unknowns are involved; the amount of recapture returned each year and the amount of yield income that is received. Level terminal income assumes that the recapture of an investment is based on the premise of sinking fund recapture. Therefore, in a level terminal income stream the recapture is a series of progressively increasing amounts, while the amount of yield income decreases in proportion. By comparison, with a straight-line declining terminal income stream, the recapture portion is a series of equal annual amounts and the portion of net income that represents yield declines in equal annual amounts.

The first step in deriving a yield rate is to determine the indicated OverAll Rate. The OverAll Rate, which provides for both return OF and return ON the investment, will be greater than the Yield Rate, which only provides for return ON investment; the OverAll Rate there provides a starting point for the determination of the indicated yield rate – the Yield Rate will be less than the OverAll Rate.

Using a test yield rate that is lower than the OAR, an income imputable to the land (land value multiplied by the yield rate) is determined. The NIBR minus the income imputed to land, NIL, leaves a residual income imputed to the improvements or building, NIBRB. The income imputed to the building can be converted into an indication of value for the building by using a Present Worth of 1 per Period [PW1/P] factor, and multiplying the building income by the PW1/P factor. The PW1/P is based on the hypothetical yield rate and the investor's anticipated remaining economic life of the building. It may require several tests of different yield rates before a yield rate is found that results in an indicated building value that approximates the investor's opinion of building value.

Derivation of an indicated Yo for the constant terminal income is determined by trial-and-error because we have two unknowns:

- The amount of recapture each year and

- The amount of yield income each year.

The steps to derive an indicated Yo are:

- Process the anticipated income down to anticipated NIBR.

- Derive an OAR – this will be the starting point for the trial-and-error testing. (The OverAll Rate, which includes a component of recapture, will be higher than the Yield rate, which doesn't include recapture.)

- Select a test Yield rate [Yt] – if you are using the AH 505, select the first rate in the compound interest tables that is lower than the calculated OAR from Step 1. (For instance, if the OAR were 6.9%, you would first test using a 6½ percent rate.

- Calculate the net income to the land by multiplying the land value by the test yield rate, Yt … NIL = LV × Yt.

- Calculate the Net Operating Income imputable to the improvement or building [NIBRB], by subtracting the land net income [NIL] from the property NIBR (NOI) … NIBRB = NIBR − NIL.

- Convert the building income [NIBRB] to an indicated building value [BV] by multiplying the NIBRB by the annuity factor [PW1/P], at the test yield rate Yt, for the anticipated remaining economic life of the building … BV = NIBRB × PW1/P (Yt, Ann, REL).

- Compare this building value to the actual building value. Repeat these steps, as necessary, until the indicated building value and actual building value are nearly equal.

The information needed to process a yield rate for level terminal income stream is:

- Anticipated gross income

- Anticipated vacancy and collection loss

- Anticipated expenses (or expense ratio)

- Anticipated property taxes

- Estimate of land value

- Estimate of improvement's (building's) remaining economic life

- Sales price

EXAMPLE 13-2: Deriving a Yield Rate for a Level Terminal Income Stream

Based on the information that has been supplied by the buyers of the apartment complex (used in Example 13-1), the OAR of the property is determined to be 9.6 percent. (Refer to Example 11-1 for how to derive the OAR.) The improvement value is $725,000. Assuming a level terminal income premise, a yield rate (Yo) can be determined as follows:

-

First, assuming a trial rate of 9½ percent (which we chose because it is the next rate in our tables lower than the 9.6 percent OAR) produces the following improvement value:

NIBR=$81,650Land income ($125,000 × 0.095)−$11,875Income to the Improvement=$69,775PW1/P (9.5%, ann, 40 yrs)×10.247247Indicated Improvement Value$715,002 -

Since the indicated improvement value is LOWER than the buyers' estimate of $725,000 for the improvements, the yield rate must be LOWER than 9½ percent. Assuming a second trial yield rate of 9 percent, the indicated improvement value would be as follows:

NIBR=$81,650Land Income ($125,000 × 0.09)−$11,250Income to the Improvement=$70,400PW1/P (9%, ann, 40 yrs)×10.757360Indicated Improvement Value$757,318 - Since the improvement value is HIGHER than the buyers' opinion of $725,000, the yield rate must be HIGHER than 9 percent, but LOWER than 9½ percent. With the compound interest tables in the AH 505 listing rates at ½-percent intervals, it is impossible to determine an exact yield rate indicator. An interpolation may be calculated, or the precise yield rate may be determined with the aid of a financial calculator or personal computer.

- Therefore:

9% < Yo < 9½%

(Using a financial calculator or computer, which would go through the same iterative process, but might ask the user to guess what the rate will be (for a starting point), and would complete the calculations in seconds, the rate would be determined to be about 9.3778 percent.)

Note: Remember “IRV” − I = R × V? Rates and values are inversely proportional, that is, income remaining constant, a lower rate will produce a higher value, and conversely, a higher rate will produce a lower value.

Note: Before proceeding on to the next lesson, be sure to complete the exercises for this lesson.