Valuation of Personal Property and Fixtures – Lesson 3 – Percent Good Factors

Appraisal Training: Self-Paced Online Learning Session

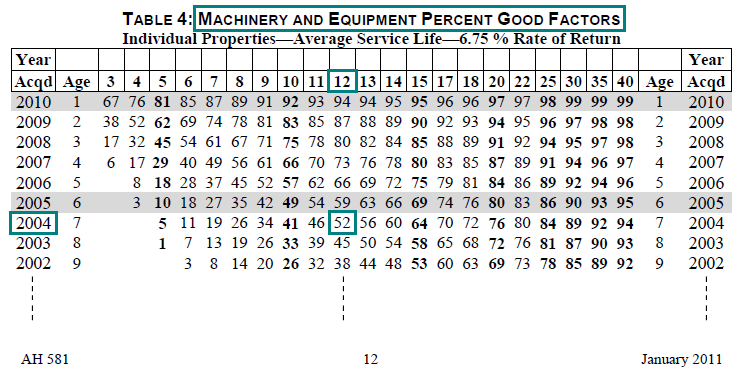

This lesson discusses percent good factors, the second of the three types of factor tables which are published annually by the Board in Assessors' Handbook Section 581, Equipment and Fixtures Index, Percent Good and Valuation Factors (AH 581). Percent good factors are used in conjunction with index factors to estimate the reproduction cost new less normal depreciation (RCNLD) of business equipment and fixtures. However, because RCNLD is based on normal depreciation – loss of value from any cause – if the equipment or fixture has experienced a loss in value greater or less than normal depreciation, additional value adjustments may be needed in order to render the property's market value on lien date. Application of index factors to arrive at reproduction cost new for equipment and fixtures was discussed in Lesson 2: Index Factor; as discussed previously reproduction cost new and replacement cost new are similar when the equipment has undergone minimal changes in technology. Application of percent good factors to reproduction cost new to arrive at an estimate of value for equipment or fixtures is discussed in this lesson.

Percent good factors are presented in the following three Assessors' Handbook Section 581 tables:

- Table 4: Machinery and Equipment

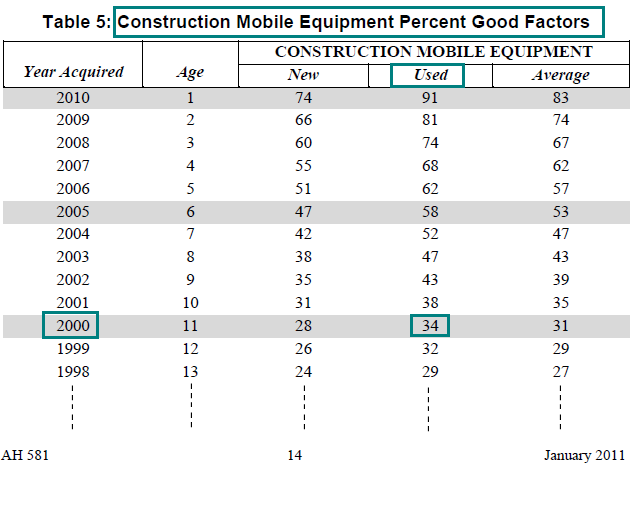

- Table 5: Construction Mobile Equipment

- Table 6: Agricultural Mobile Equipment

NOTE: while all the demonstrations, examples, and exercises shown in this lesson use lien date 2011 for illustrative purposes, it must be remembered that it is the lien date for which values are sought that determines which AH 581 – and associated factors – will be used. The Board of Equalization's website contains several years of AH 581 publications, which can be accessed through: AH 581 Tables.

Definitions

This lesson uses several terms that you should be familiar with; below are definitions for certain terms that are used throughout this lesson.

- Percent Good: percent good refers to the portion of benefits remaining in an asset (property/equipment/fixture) compared to the total benefits when new. In a mass appraisal program, percent good factors are frequently used to estimate depreciation. Percent good, as a percentage, is the complement of depreciation; for example, if a property has depreciated 20 percent, it is 80 percent good.

- Average Service Life or Economic Life: a measure of the period over which certain types of equipment and fixtures are expected to be usable, with normal repairs and maintenance. It is a probable life expectancy. Note: the economic life of equipment or fixtures may be shorter than their physical life, if the cost of their continued use exceeds the benefits derived from such use, even though they are still physically capable of continued use

- Equipment: the term “equipment” should be thought to encompass fixtures, as well, when used by itself in discussions relative to the applicability of index and/or percent good factors to the valuation of such. (Fixtures are discussed in Lesson 1: Overview.)

Machinery and Equipment

Table 4 of AH 581 provides percent good factors for use in valuing machinery and equipment; specifically for commercial, industrial, non-mobile construction, and non-mobile agricultural equipment. Application of percent good factors to the reproduction cost new of such equipment typically produces the reproduction cost new less (normal) depreciation (RCNLD) of the property. While the percent good factors in Table 4 are used in estimating the RCLND of non-mobile construction and non-mobile agricultural equipment, it is important to note that there are separate AH 581 percent good factors for use in estimating the RCNLD of mobile construction equipment (Table 5) and mobile agricultural equipment (Table 6).

Note: If a minimum percent good factor is employed in conjunction with the use of Table 4 percent good factors, its use must be determined in a supportable manner as required by Revenue and Taxation Code section 401.16.

In order to locate a percent good factor in Table 4, one must first determine the average service life (economic life) for the equipment being valued. The average service life must be estimated by the appraiser; average service lives are discussed separately in Lesson 5, Determining the Economic Life / Average Service Life of Equipment and Fixtures.

Note: Average service lives have been provided for demonstrations and examples shown in this lesson.

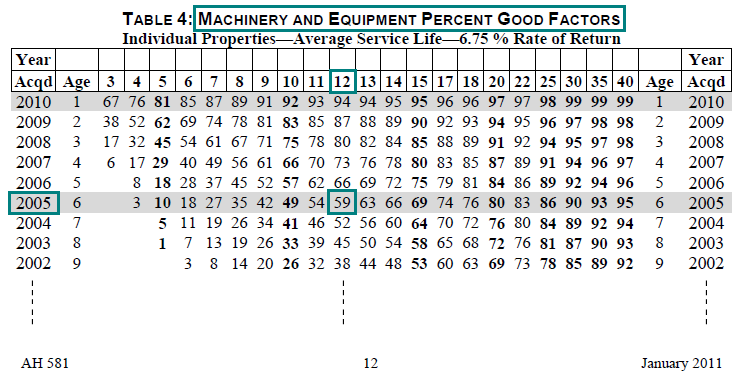

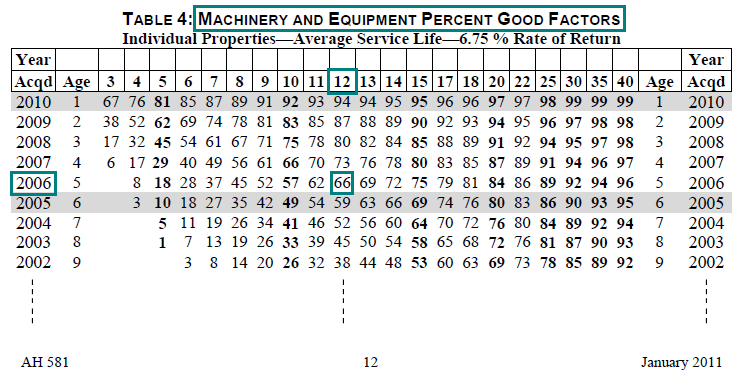

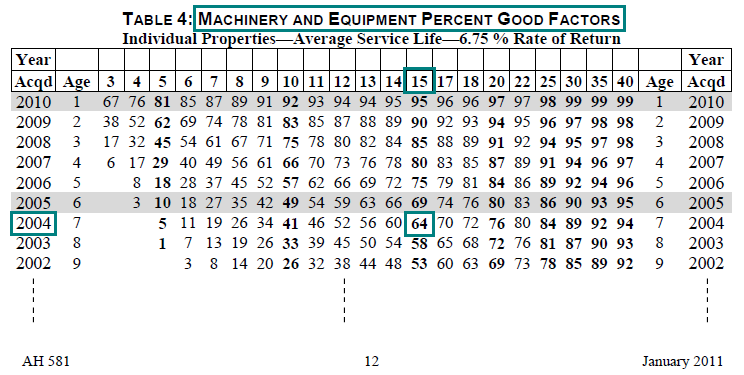

The column headings in Table 4, Machinery and Equipment Percent Good Factors, represent the average life expectancy of the equipment under consideration. Each column contains the percent good factor for the corresponding age of the equipment or fixture being valued. Table 4 was derived using the “individual method” of computation; and the rate of return used to compute the percent good factors shown in Table 4 is calculated annually, for each lien date – the rate of return is identified at the top of table.

Refer to Assessors' Handbook Section 582, Explanation of the Derivation of Equipment Percent Good Factors, for the rationale and mathematics involved in the computation of the percent good factors presented in AH 581.

Application of Machinery and Equipment Percent Factors to Calculate RCNLD

The following provides step by step demonstrations of how to use the Machinery and Equipment Percent Good Factors, found in AH 581 Table 4, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of commercial equipment, industrial equipment, non-mobile construction equipment, and non-mobile agricultural equipment. The demonstrations are arranged according to the categories of index factors presented and discussed in Lesson 2: Index Factors. Practical examples are shown after each demonstration to ensure an understanding of the application of the factors.

Commercial Equipment (Non-mobile)

Demonstration of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Commercial Equipment

The following is a step-by-step demonstration of how to use the Machinery and Equipment Percent Good Factors, found in AH 581 Table 4, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of commercial equipment, based on the equipment's estimated reproduction cost new (RCN), year acquired, and economic life (average service life):

- Calculate the reproduction cost new (RCN) of the equipment, via the application of an index factor, as discussed and demonstrated in Lesson 2: Index Factors. The reproduction cost new (RCN) for office equipment, acquired in 2005 for $10,000, is $11,600 ($10,000 × 1.16) as of lien date 2011. (RCN calculated in the Demonstration of Using Commercial Equipment Index Factors to Calculate the RCN for Commercial Equipment, found in Lesson 2: Index Factors.)

- Determine the economic life (average service life) of the equipment; as discussed and demonstrated in Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures. Office Furniture & Equipment = 12 years (Economic life determined in the Demonstration of Determining Economic Life [Average Service Life] for Commercial Equipment, found in Lesson 5.)

- Select the appropriate AH 581 (published annually) based on the lien date (January 1, XXXX) for which the estimate of the equipment's reproduction cost new less (normal) depreciation (RCNLD) is sought.

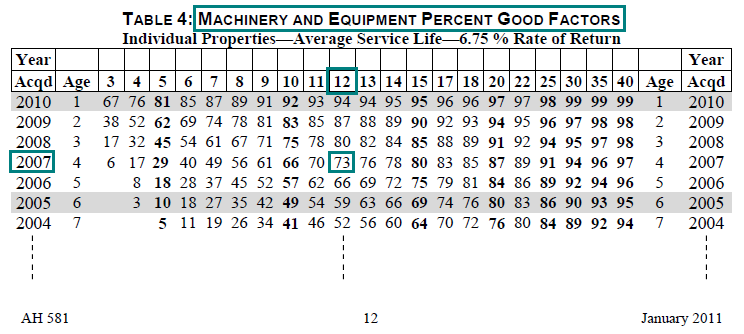

January 2011 AH 581 (lien date 2011 initially chosen for illustrative purposes only)

(Initial selection made in the Demonstration of Using Commercial Equipment Index Factors to Calculate the RCN of Commercial Equipment, found in Lesson 2.)

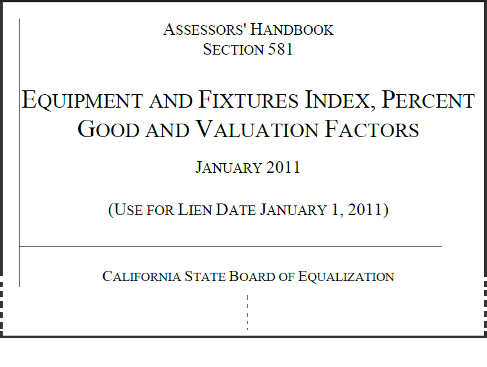

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using Table 4: Machinery and Equipment Percent Good Factors of the previously selected AH 581 (2011).

2005 Year Acquired & 12 Year Average Service (Economic) Life = 59

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) of the equipment, as of the lien date (January 1, 2011), by multiplying its reproduction cost new (RCN), by the decimal equivalent of the percent good factor (percent) found in the preceding step. RCNLD = $11,600 × .59 = $6,844 Thus, by applying the applicable index factor and percent good factor to the $10,000 acquisition cost of the office equipment, it is estimated that this equipment, purchased in 2005, has a reproduction cost new less (normal) depreciation (RCNLD), or market value, of $6,844, as of lien date 2011 (January 1, 2011).

Practical Applications of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Commercial Equipment

The following examples are designed to illustrate how to estimate the reproduction cost new less (normal) depreciation (RCNLD) of commercial equipment using the Machinery and Equipment Percent Good Factors found in Table 4 of AH 581. While the examples shown below use lien date 2011 for illustrative purposes, one must remember that it is the lien date for which values are sought that determines which yearly AH 581 – and associated factors – will be used.

Note: the economic (average service) lives of the equipment used in the following examples are provided in order to facilitate the illustrations – to understand how such economic (average service) lives are determined, see Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures.

Example 1:

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for restaurant equipment purchased and installed in 2006, for $50,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $55,500 × 0.66

- RCNLD = $36,630

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 1 of Practical Applications of Using Commercial Equipment Index Factors to Calculate RCN). RCN = $55,500 ($50,000 × 1.11)

- Determine the economic (average service) life of the equipment via review of published economic lives for equipment and fixtures, as described in Lesson 5 (see Example 1 of Practical Applications of Determining Economic Life for Commercial Equipment). Restaurants – Regular [or Fast Food Chains] = 12 years

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using 2011 AH 581 Table 4: Machinery and Equipment Percent Good Factors. 2006 Year Acquired & 12 Year Average Service (Economic) Life = 66

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $55,500 × 0.66 = $36,630

Example 2:

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for grocery store equipment purchased and installed in 2007, for $50,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $53,000 × 0.73

- RCNLD = $38,690

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 2 of Practical Applications of Using Commercial Equipment Index Factors to Calculate RCN). RCN = $53,000 ($50,000 × 1.06)

- Determine the economic (average service) life of the equipment via review of published economic lives for equipment and fixtures, as described in Lesson 5 (see Example 2 of Practical Applications of Determining Economic Life for Commercial Equipment). Grocery Stores – Supermarkets [or Convenience] = 12 years

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using 2011 AH 581 Table 4: Machinery and Equipment Percent Good Factors. 2007 Year Acquired & 12 Year Average Service (Economic) Life = 73

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $53,000 × 0.73 = $38,690

Industrial Equipment

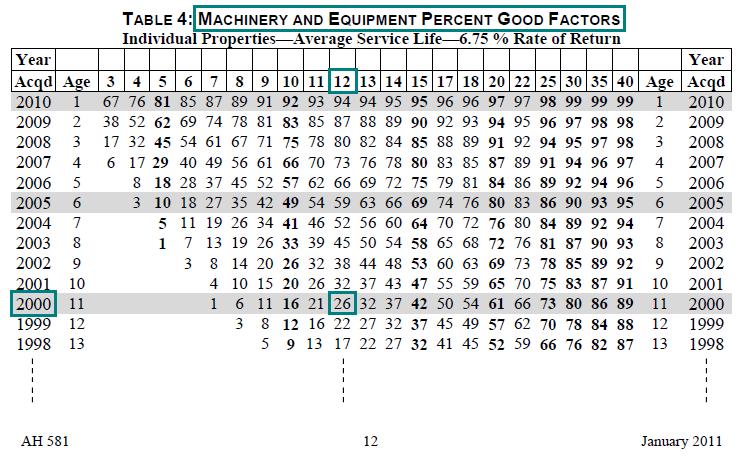

Demonstration of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Industrial Equipment

The following is a step-by-step demonstration of how to use the Machinery and Equipment Percent Good Factors, found in AH 581 Table 4, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of industrial equipment, based on the equipment's estimated reproduction cost new (RCN), year acquired, and economic life (average service life):

- Calculate the reproduction cost new (RCN) of the equipment, via the application of an index factor, as discussed and demonstrated in Lesson 2: Index Factors. The reproduction cost new (RCN) of cement manufacturing equipment, acquired in 2000 for $1,000,000, is $1,200,000 ($1,000,000 × 1.20) as of lien date 2011. (RCN calculated in the Demonstration of Using Industrial Equipment Index Factors to Calculate RCN, found in Lesson 2: Index Factors.)

- Determine the economic life (average service life) of the equipment; as discussed and demonstrated in Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures. Cement Manufacturing = 30 years (Economic life determined in the Demonstration of Determining Economic Life [Average Service Life] for Industrial Equipment, found in Lesson 5.)

- Select the appropriate AH 581 (published annually) based on the lien date (January 1, XXXX) for which the estimate of the equipment's reproduction cost new less (normal) depreciation (RCNLD) is sought.

January 2011 AH 581 (lien date 2011 initially chosen for illustrative purposes only)

(Selection made in the Demonstration of Using Industrial Equipment Index Factors to Calculate RCN, found in Lesson 2: Index Factors.)

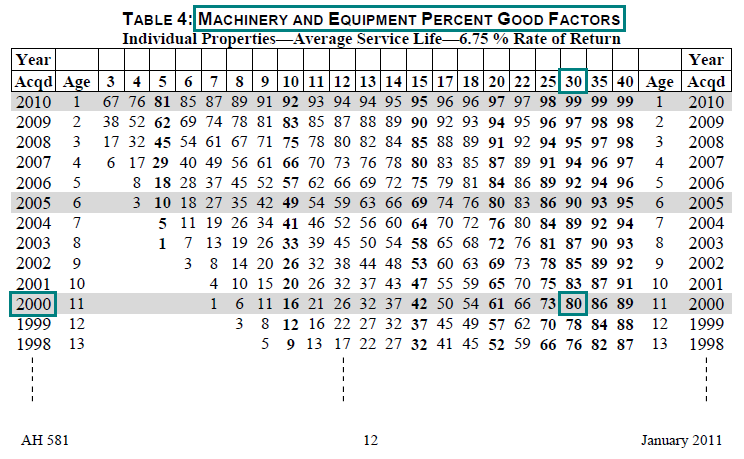

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using Table 4: Machinery and Equipment Percent Good Factors of the previously selected AH 581 (2011).

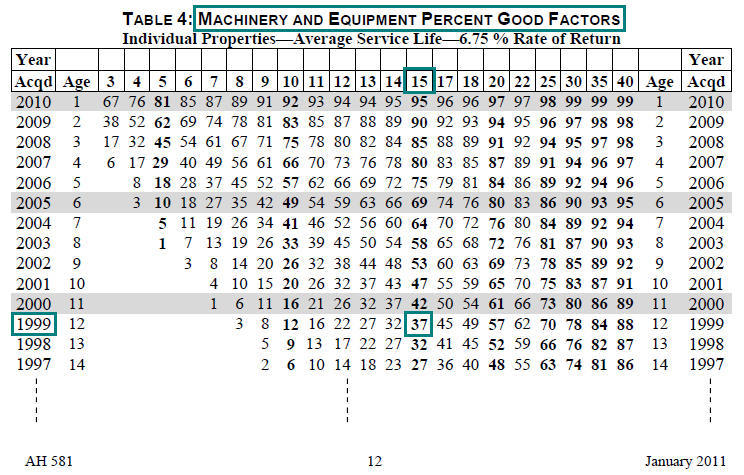

2000 Year Acquired & 30 Year Average Service (Economic) Life = 80

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) of the equipment, as of the lien date (January 1, 2011), by multiplying its reproduction cost new (RCN), by the decimal equivalent of the percent good factor (percent) found in the preceding step. RCNLD = $1,200,000 × .80 = $960,000 Thus, by applying the applicable index factor and percent good factor to the $1,000,000 acquisition cost of the cement manufacturing equipment, it is estimated that this equipment, purchased in 2000, has a reproduction cost new less (normal) depreciation (RCNLD), or market value, of $960,000, as of lien date 2011 (January 1, 2011).

Practical Applications of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Industrial Equipment

The following examples are designed to illustrate how to estimate the reproduction cost new less (normal) depreciation (RCNLD) of industrial equipment using the Machinery and Equipment Percent Good Factors found in Table 4 of AH 581. While the examples shown below use lien date 2011 for illustrative purposes, one must remember that it is the lien date for which values are sought that determines which yearly AH 581 – and associated factors – will be used.

Note: the economic (average service) lives of the equipment used in the following examples are provided in order to facilitate the illustrations – to understand how such economic (average service) lives are determined, see Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures.

Example 1:

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for food processing equipment purchased and installed in 2000, for $500,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $600,000 × 0.42

- RCNLD = $252,000

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 1 of Practical Applications of Using Industrial Equipment Index Factors to Calculate RCN). RCN = $600,000 ($500,000 × 1.20)

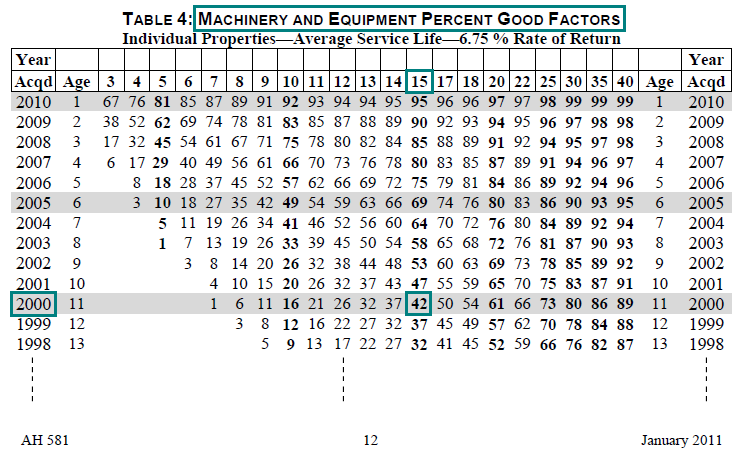

- Determine the economic (average service) life of the equipment via review of published economic lives for equipment and fixtures, as described in Lesson 5 (see Example 1 of Practical Applications of Determining Economic Life for Industrial Equipment). Food Processing = 15 Years

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using 2011 AH 581 Table 4: Machinery and Equipment Percent Good Factors. 2000 Year Acquired & 15 Year Average Service (Economic) Life = 42

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $600,000 × 0.42 = $252,000

Example 2:

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for apparel (clothing) manufacturing equipment purchased and installed in 2004, for $250,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $287,500 × 0.52

- RCNLD = $149,500

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 2 of Practical Applications of Using Industrial Equipment Index Factors to Calculate RCN). RCN = $287,500 ($250,000 × 1.15)

- Determine the economic (average service) life of the equipment via review of published economic lives for equipment and fixtures, as described in Lesson 5 (see Example 2 of Practical Applications of Determining Economic Life for Industrial Equipment). Apparel Manufacturing = 12 Years

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using 2011 AH 581 Table 4: Machinery and Equipment Percent Good Factors. 2004 Year Acquired & 12 Year Average Service (Economic) Life = 52

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $287,500 × 0.52 = $149,500

Construction Equipment (Non-mobile)

As previously described, in calculating reproduction cost new less normal depreciation (RCNLD) for non-mobile construction equipment, the percent good factors in Table 4, Machinery and Equipment Percent Good Factors, are applied to the reproduction cost new (RCN) of the equipment; RCN was calculated using Table 3, Agricultural and Construction Equipment Index Factors. Although there is only one index factor table for use with construction equipment, in AH 581, there are two separate percent good factor tables for use with construction equipment – use depending on whether the equipment is mobile or non-mobile. Application of Table 5 percent good factors to mobile construction equipment will be discussed later in this lesson; below focuses on application of Table 4 percent good factors to non-mobile construction equipment.

Demonstration of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Non-Mobile Construction Equipment

The following is a step-by-step demonstration of how to use the Machinery and Equipment Percent Good Factors, found in AH 581 Table 4, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of non-mobile construction equipment, based on the equipment's estimated reproduction cost new (RCN), year acquired, and economic life (average service life):

- Calculate the reproduction cost new (RCN) of the equipment, via the application of an index factor, as discussed and demonstrated in Lesson 2: Index Factors. The reproduction cost new (RCN) of a light plant, acquired in 2000 for $100,000, is $128,000 ($100,000 × 1.28) as of lien date 2011. (RCN calculated in the Demonstration of Using Construction Equipment Index Factors to Calculate RCN, found in Lesson 2: Index Factors.)

- Determine the economic life (average service life) of the equipment; as discussed and demonstrated in Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures. Construction / Demolition Contractor = 12 years (Economic life determined in the Demonstration of Determining Economic Life [Average Service Life] for Non-Mobile Construction Equipment, found in Lesson 5.)

- Select the appropriate AH 581 (published annually) based on the lien date (January 1, XXXX) for which the estimate of the equipment's reproduction cost new less (normal) depreciation (RCNLD) is sought.

January 2011 AH 581 (lien date 2011 initially chosen for illustrative purposes only)

(Selection made in the Demonstration of Using Construction Equipment Index Factors to Calculate RCN, found in Lesson 2: Index Factors.)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using Table 4: Machinery and Equipment Percent Good Factors of the previously selected AH 581 (2011).

2000 Year Acquired & 12 Year Average Service (Economic) Life = 26

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) of the equipment, as of the lien date (January 1, 2011), by multiplying its reproduction cost new (RCN), by the decimal equivalent of the percent good factor (percent) found in the preceding step. RCNLD = $128,000 × 0.26 = $33,280 Thus, by applying the applicable index factor and percent good factor to the $100,000 acquisition cost of the light plant, it is estimated that this equipment, purchased in 2000, has a reproduction cost new less (normal) depreciation (RCNLD), or market value, of $33,280, as of lien date 2011 (January 1, 2011).

Practical Application of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Non-Mobile Construction Equipment

The following example is designed to illustrate how to estimate the reproduction cost new less (normal) depreciation (RCNLD) of non-mobile construction equipment using the Machinery and Equipment Percent Good Factors found in Table 4 of AH 581. While the example shown below uses lien date 2011 for illustrative purposes, one must remember that it is the lien date for which values are sought that determines which yearly AH 581 – and associated factors – will be used.

Note: the economic (average service) life of the equipment used in the following example is provided in order to facilitate the illustration – to understand how such an economic (average service) life is determined, see Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures.

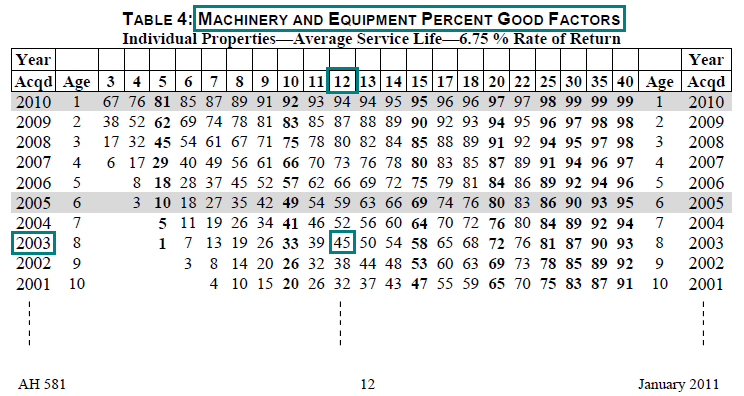

Example 1 (non-mobile construction equipment):

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for a large volume pump (non-mobile construction equipment) purchased and installed in 2003, for $50,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $62,500 × 0.45

- RCNLD = $28,125

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 1 of Practical Applications of Using Construction Equipment Index Factors to Calculate RCN). RCN = $62,500 ($50,000 × 1.25)

- Determine the economic (average service) life of the equipment via review of published economic lives for equipment and fixtures, as described in Lesson 5 (see Example 1 of Practical Applications of Determining Economic Life for Construction Equipment). Construction / Demolition Contractor = 12 Years

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using 2011 AH 581 Table 4: Machinery and Equipment Percent Good Factors. 2003 Year Acquired & 12 Year Average Service (Economic) Life = 45

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCLND = $62,500 × 0.45 = $28,125

Agricultural Equipment (Non-mobile)

As previously described, in calculating reproduction cost new less normal depreciation (RCNLD) for non-mobile agricultural equipment, the percent good factors in Table 4, Machinery and Equipment Percent Good Factors, are applied to the reproduction cost new (RCN) of the equipment; RCN was calculated using Table 3, Agricultural and Construction Equipment Index Factors. Although there is only one index factor table for use with agricultural equipment, in AH 581, there are two separate percent good factor tables for use with agricultural equipment – use depending on whether the equipment is mobile or non-mobile. Application of Table 6 percent good factors to mobile agricultural equipment will be discussed later in this lesson; below focuses on application of Table 4 percent good factors to non-mobile agricultural equipment.

Demonstration of Using Machinery and Equipment Percent Good Factors to Calculate RCLND of Non-Mobile Agricultural Equipment

The following is a step-by-step demonstration of how to use the Machinery and Equipment Percent Good Factors, found in AH 581 Table 4, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of non-mobile agricultural equipment, based on the equipment's estimated reproduction cost new (RCN), year acquired, and economic life (average service life):

- Calculate the reproduction cost new (RCN) of the equipment, via the application of an index factor, as discussed and demonstrated in Lesson 2: Index Factors. The reproduction cost new (RCN) of a cotton gin, acquired in 2004 for $100,000, is $122,000 ($100,000 × 1.22) as of lien date 2011. (RCN calculated in the Demonstration of Using Agricultural Equipment Index Factors to Calculate RCN, found in Lesson 2: Index Factors.)

- Determine the economic life (average service life) of the equipment, as discussed and demonstrated in Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures. Cotton Gins = 15 years (Economic life determined in the Demonstration of Determining Economic Life [Average Service Life] for Non-Mobile Agricultural Equipment, found in Lesson 5.)

- Select the appropriate AH 581 (published annually) based on the lien date (January 1, XXXX) for which the estimate of the equipment's reproduction cost new less (normal) depreciation (RCNLD) is sought.

January 2011 AH 581 (lien date 2011 initially chosen for illustrative purposes only)

(Selection made in the Demonstration of Using Agricultural Equipment Index Factors to Calculate RCN, found in Lesson 2: Index Factors.)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using Table 4: Machinery and Equipment Percent Good Factors of the previously selected AH 581 (2011).

2004 Year Acquired & 15 Year Average Service (Economic) Life = 64

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) of the equipment, as of the lien date (January 1, 2011), by multiplying its reproduction cost new (RCN), by the decimal equivalent of the percent good factor (percent) found in the preceding step. RCNLD = $122,000 × .64 = $78,080 Thus, by applying the applicable index factor and percent good factor to the $100,000 acquisition cost of the cotton gin, it is estimated that this equipment, purchased in 2005, has a reproduction cost new less (normal) depreciation (RCNLD), or market value, of $78,080, as of lien date 2011 (January 1, 2011).

Practical Application of Using Machinery and Equipment Percent Good Factors to Calculate RCNLD of Non-Mobile Agricultural Equipment

The following example is designed to illustrate how to estimate the reproduction cost new less (normal) depreciation (RCNLD) of non-mobile agricultural equipment using the Machinery and Equipment Percent Good Factors found in Table 4 of AH 581. While the example shown below uses lien date 2011 for illustrative purposes, one must remember that it is the lien date for which values are sought that determines which yearly AH 581 – and associated factors – will be used.

Note: the economic (average service) life of the equipment used in the following example is provided in order to facilitate the illustration – to understand how such an economic (average service) life is determined, see Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures.

Example 1 (non-mobile agricultural equipment):

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for dairy equipment (non-mobile) purchased and installed in 1999, for $150,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $199,500 × 0.37

- RCNLD = $73,815

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 1 of Practical Applications of Using Agricultural Equipment Index Factors to Calculate RCN). RCN = $199,500 ($150,000 × 1.33)

- Determine the economic (average service) life of the equipment via review of published economic lives for equipment and fixtures, as described in Lesson 5 (see Example 1 of Practical Applications of Determining Economic Life for Agricultural Equipment). Dairies = 15 years

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and average service (economic) life, using 2011 AH 581 Table 4: Machinery and Equipment Percent Good Factors. 1999 Year Acquired & 15 Year Average Service (Economic) Life = 37

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $199,500 × 0.37 = $73,815

Construction Mobile Equipment

Table 5 of AH 581 provides percent good factors for mobile construction equipment. This is one of the three percent good factor tables published in AH 581. Application of the percent good factors, comprising Table 5 of AH 581, to mobile construction equipment's reproduction cost new typically produces the reproduction cost new less normal depreciation of the equipment.

The percent good factors in Table 5 are used for “mobile” construction equipment; this is an important distinction to make, since the percent good factors in Table 4 are used for “non-mobile” construction equipment.

Table 5, Construction Mobile Equipment Percent Good Factors, was derived from a detailed analysis of used equipment sales data.

The percent good factor table for mobile construction equipment is divided into three categories of equipment: “New”, “Used”, and “Average”. The “New” percent good factors are to be used in valuing equipment purchased new. The “Used” percent good factors are to be used in valuing equipment which was purchased used. And lastly, the “Average” percent good factors are to be used – and only so – when there is no indication of whether the equipment was purchased new or used.

Note: If a minimum percent good factor is employed in conjunction with the use of Table 5 percent good factors, its use must be determined in a supportable manner as required by Revenue and Taxation Code section 401.16.

Demonstration of Using Construction Mobile Equipment Percent Good Factors to Calculate RCNLD of Mobile Construction Equipment

The following is a step-by-step demonstration of how to use the Construction Mobile Equipment Percent Good Factors, found in Table 5 of AH 581, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of mobile construction equipment, based on the equipment's estimated reproduction cost new (RCN), year acquired, and purchase condition category:

- Calculate the reproduction cost new (RCN) of the equipment, via the application of an index factor, as discussed and demonstrated in Lesson 2: Index Factors. The reproduction cost new (RCN) of a motor grader, acquired used in 2000 for $100,000, is $128,000 ($100,000 × 1.28). (RCN calculated in the Demonstration of Using Construction Equipment Index Factors, found in Lesson 2: Index Factors.)

- Select the appropriate AH 581 publication (published annually) based on the lien date (January 1, XXXX) for which the estimate of the equipment's reproduction cost new less (normal) depreciation (RCNLD) is sought.

January 2011 AH 581 (lien date 2011 initially chosen for illustrative purposes only)

(Selection was made in the Demonstration of Using Construction Equipment Index Factors, found in Lesson 2: Index Factors.)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and purchase condition category (New, Used, or Average [unknown]), using Table 5: Construction Mobile Equipment Percent Good Factors of the previously selected AH 581 (2011).

2000 Year Acquired & Purchased Used = 34

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, as of the lien date (January 1, 2011), by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step. RCNLD = $128,000 × 0.34 = $43,520 Thus, by applying the applicable index factor and percent good factor to the $100,000 acquisition cost of the used motor grader, it is estimated that this equipment, purchased in 2006, has a reproduction cost new less (normal) depreciation (RCNLD), or market value, of $43,520, as of lien date 2011 (January 1, 2011).

Practical Applications of Using Construction Mobile Equipment Percent Good Factors to Calculate RCNLD of Mobile Construction Equipment

The following examples are designed to illustrate how to estimate the reproduction cost new less (normal) depreciation (RCNLD) of mobile construction equipment using the Construction Mobile Equipment Percent Good Factors found in Table 5 of AH 581. While the examples shown below use lien date 2011 for illustrative purposes, it must be remembered that it is the lien date for which values are sought that determines which yearly AH 581 – and associated factors – will be used.

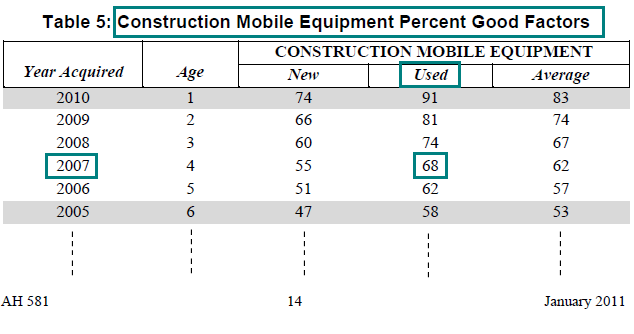

Example 1 (mobile construction equipment):

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for a bulldozer purchased used and delivered in 2007, for $120,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $127,200 × 0.68

- RCNLD = $86,496

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 2 of Practical Applications of Using Construction Equipment Index Factors to Calculate RCN). RCN = $127,200 ($120,000 × 1.06)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and purchase condition category (New, Used, or Average [unknown]), using 2011 AH 581 Table 5: Construction Mobile Equipment Percent Good Factors. 2007 Year Acquired & Purchased Used = 68

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $127,200 × 0.68 = $86,496

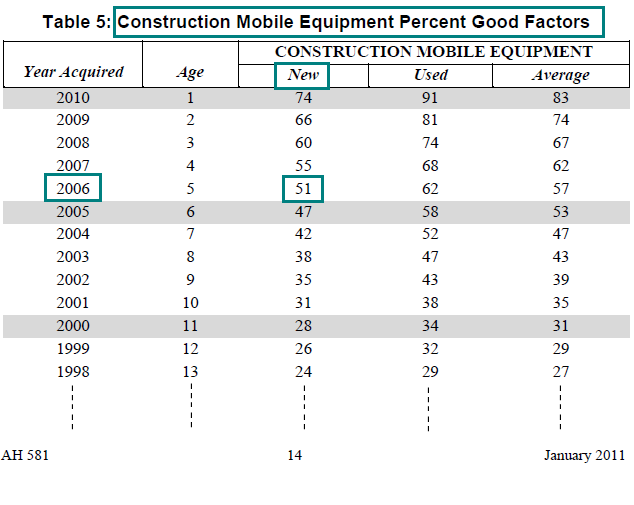

Example 2 (mobile construction equipment):

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for a truck-mounted crane purchased new and delivered in 2006, for $120,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $130,800 × 0.51

- RCNLD = $66,708

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 3 of Practical Applications of Using Construction Equipment Index Factors to Calculate RCN). RCN = $130,800 ($120,000 × 1.09)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age) and purchase condition category (New, Used, or Average [unknown]), using 2011 AH 581 Table 5: Construction Mobile Equipment Percent Good Factors. 2006 Year Acquired & Purchased New = 51

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $130,800 & 0.51 = $66,708

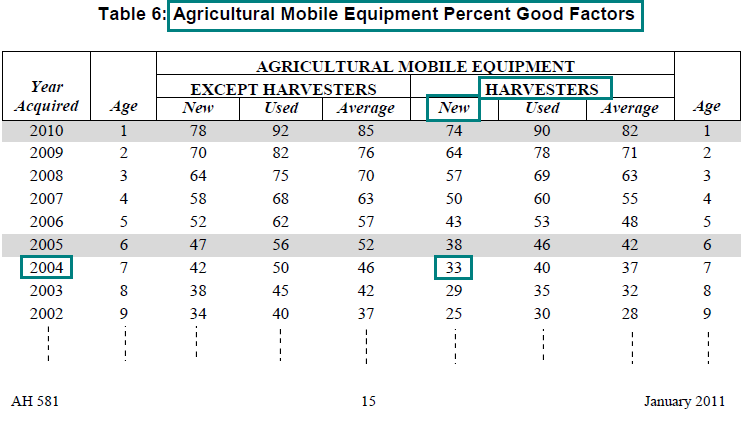

Agricultural Mobile Equipment

Table 6 of AH 581 provides percent good factors for mobile agricultural equipment. This is one of the three percent good factor tables published in AH 581. Application of the percent good factors, comprising Table 6 of AH 581, to mobile agricultural equipment's reproduction cost new typically produces the reproduction cost new less normal depreciation of the equipment.

The percent good factors in Table 6 are used for “mobile” agricultural equipment; this is an important distinction to make, since the percent good factors in Table 4 are used for “non-mobile” agricultural equipment.

Table 6, Agricultural Mobile Equipment Percent Good Factors, was derived from a detailed analysis of used equipment sales data.

The percent good factor table for mobile agricultural equipment is divided into two groups of equipment: “Harvesters” and agricultural mobile equipment “Except Harvesters”. In addition, within each group the percent good factor tables for each group are further divided into three categories of equipment: “New”, “Used”, and “Average”. The “New” percent good factors are to be used in valuing equipment purchased new. The “Used” percent good factors are to be used in valuing equipment which was purchased used. And lastly, the “Average” percent good factors are to be used – and only so – when there is no indication of whether the equipment was purchased new or used.

Note: If a minimum percent good factor is employed in conjunction with the use of Table 6 percent good factors, its use must be determined in a supportable manner as required by Revenue and Taxation Code section 401.16.

Demonstration of Using Agricultural Mobile Equipment Percent Good Factors to Calculate RCNLD of Mobile Agricultural Equipment

The following is a step-by-step demonstration of how to use the Agricultural Mobile Equipment Percent Good Factors, found in Table 6 of AH 581, to estimate the reproduction cost new less (normal) depreciation (RCNLD) of mobile agricultural equipment, based on the equipment's estimated reproduction cost new (RCN), year acquired, equipment type, and purchase condition category:

- Calculate the reproduction cost new (RCN) of the equipment, via the application of an index factor, as discussed and demonstrated in Lesson 2: Index Factors. The reproduction cost new (RCN) of a cotton harvester, acquired new in 2004 for $100,000, is $122,000 ($100,000 × 1.22). (RCN calculated in the Demonstration of Using Agricultural Equipment Index Factors, found in Lesson 2: Index Factors.)

- Select the appropriate AH 581 publication (published annually) based on the lien date (January 1, XXXX) for which the estimate of the equipment's reproduction cost new less (normal) depreciation (RCNLD) is sought.

January 2011 AH 581 (lien date 2011 initially chosen for illustrative purposes only)

(Selection was made in the Demonstration of Using Agricultural Equipment Index Factors, found in Lesson 2: Index Factors.)

- Locate the percent good factor corresponding to the equipment's: (1) year of acquisition (age), (2) type (harvesters or mobile agricultural equipment except harvesters), and (3) purchase condition category (New, Used, or Average [unknown]); using Table 6: Agricultural Mobile Equipment Percent Good Factors of the previously selected AH 581 (2011).

2004 Year Acquired & Harvester & Purchased New = 33

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, as of the lien date (January 1, 2011), by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (found in the preceding step). RCNLD = $122,000 × 0.33 = $40,260 Thus, by applying the applicable index factor and percent good factor to the $100,000 acquisition cost of the cotton harvester, it is estimated that this equipment, purchased in 2004, has a reproduction cost new less (normal) depreciation (RCNLD), or market value, of $40,260, as of lien date 2011 (January 1, 2011).

Practical Applications of Using Agricultural Mobile Equipment Percent Good Factors to Calculate RCNLD of Mobile Agricultural Equipment

The following examples are designed to illustrate how to estimate the reproduction cost new less (normal) depreciation (RCNLD) of mobile agricultural equipment using the Agricultural Mobile Equipment Percent Good Factors found in Table 6 of AH 581. While the examples shown below use lien date 2011 for illustrative purposes, it must be remembered that it is the lien date for which values are sought that determines which yearly AH 581 – and associated factors – will be used.

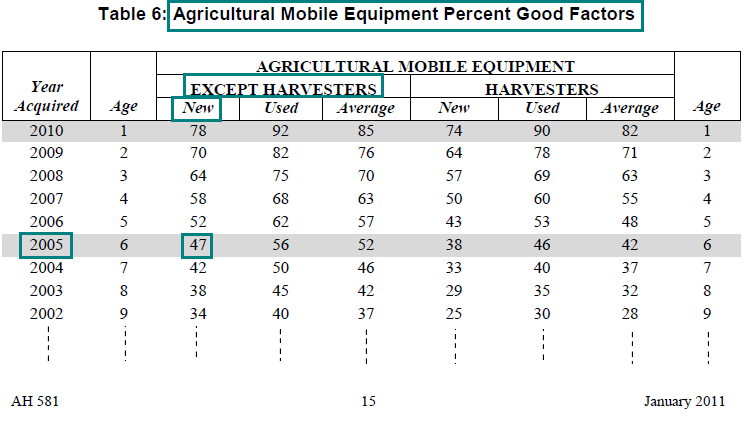

Example 1 (mobile agricultural equipment):

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for a farm tractor purchased new and delivered in 2005, for $150,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $174,000 × 0.47

- RCNLD = $81,780

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 2 of Practical Applications of Using Agricultural Equipment Index Factors to Calculate RCN). RCN = $174,000 ($150,000 × 1.16)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age), type (harvesters or mobile agricultural equipment except harvesters), and purchase condition category (New, Used, or Average [unknown]), using 2011 AH 581 Table 6: Agricultural Mobile Equipment Percent Good Factors. 2005 Year Acquired & Non-Harvester & Purchased New = 47

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $174,000 × 0.47 = $81,780

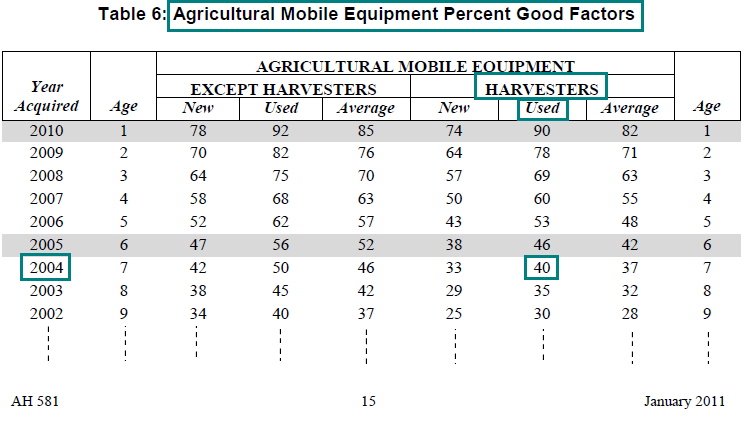

Example 2 (mobile agricultural equipment):

What is the reproduction cost new less (normal) depreciation (RCNLD), as of lien date 2011 (January 1), for a rice combine purchased used and delivered in 2004, for $150,000?

Solution:

- RCNLD = RCN × Percent Good Factor (converted to a decimal equivalent)

- RCNLD = $183,000 × 0.40

- RCNLD = $73,200

- Calculate the reproduction cost new (RCN) for the equipment, as described in Lesson 2 (see Example 3 of Practical Applications of Using Agricultural Equipment Index Factors to Calculate RCN). RCN = $183,000 ($150,000 × 1.22)

- Locate the percent good factor corresponding to the equipment's year of acquisition (age), type (harvesters or mobile agricultural equipment except harvesters), and purchase condition category (New, Used, or Average [unknown]), using 2011 AH 581 Table 6: Agricultural Mobile Equipment Percent Good Factors. 2004 Year Acquired & Harvester & Purchased Used = 40

- Calculate the reproduction cost new less (normal) depreciation (RCNLD) for the equipment, by multiplying its reproduction cost new (RCN) by the decimal equivalent of the percent good factor (percent) found in the preceding step.

RCNLD = $183,000 × 0.40 = $73,200

Lesson Summary

The lesson you just read on application of percent good factors, demonstrates how to arrive at estimates of reproduction cost new less (normal) depreciation for equipment and fixtures, using the percent good factors, in conjunction with index factors, published in the AH 581. Selection of the applicable percent good factor is based on the acquisition year and economic (average service) life of the equipment or fixture being valued, where the type of equipment or fixture being valued uses the factors found in AH 581 Table 4 – Machinery and Equipment Percent Good Factors – as opposed to mobile construction or agricultural equipment, which use factors found in AH 581, Table 5 and Table 6. Determination of the economic (average service) life of equipment and fixtures is discussed in Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures.

Note: Before proceeding on to the next lesson, be sure to complete the exercises for this lesson.