Valuation of Personal Property and Fixtures – Lesson 6 – Factor Adjustments

Appraisal Training: Self-Paced Online Learning Session

This lesson discusses the factor adjustment necessary in order to account for the effects of technological changes bearing on the value of equipment as recommended in AH 581. In Lesson 2, we discussed the use of recommended maximum equipment index factors to address the effects of technological changes on the reproduction cost new of equipment. This lesson explains how to determine and use recommended maximum equipment index factors in relation to the equipment index factors found in Assessors' Handbook Section 581, Equipment and Fixtures Index, Percent Good and Valuation Factors.

Definitions

This lesson uses several terms that you should be familiar with; below are terms essential to a fruitful understanding of the lesson material.

- Economic Life (Average Service Life): a measure of the period over which certain types of equipment and fixtures are expected to be usable with normal repairs and maintenance. It is a probable life expectancy. Note: the economic life of equipment or fixtures may be shorter than their physical life, if the cost of their continued use exceeds the benefits derived from such use, even though they are still physically capable of continued use.

- Personal Property: is, for California property tax purposes, all property except real property. (California Revenue and Taxation Code section 106)

- Equipment: the term “equipment” should be thought to encompass fixtures, as well, when used by itself in discussions relative to the applicability of index and/or percent good factors to the valuation of such. (Fixtures are discussed in Lesson 1, Overview.)

- Cost: is, for property tax purposes, the expenditure required to develop and construct an improvement – fixtures are improvements and improvements are real property – or acquire personal property, including applicable sales tax, shipping charges, and installation costs.

The Concept: Maximum Index Factor

Due to rapid technological changes which have taken place in recent years, it is recommended that a maximum index factor be used when valuing business personal property (equipment). As stated in Lesson 2, the maximum index factor currently recommended is the factor corresponding to equipment of an age equal to 125% of the estimated economic (average service) life of such equipment. The use of a maximum index factor is recommended for commercial, industrial, agricultural, and construction equipment.

In practical terms, the maximum index factor is used when the equipment being valued is older – by 25% or more – than the economic/average service life for that type of equipment. If the equipment being valued is not older, by 25% or more, than the economic life for that type of equipment, then the appraiser does not need to determine the maximum index factor. In such cases, the applicable index factor, in the AH 581 table, is the one corresponding to the acquisition year of the equipment being valued.

The following demonstrations and examples show how to determine the Recommended Maximum Equipment Index Factor to use based on the type of equipment being valued and its economic life. Additionally, they show application of the maximum equipment index factor based on the equipment's acquisition cost and year.

The economic (average service) lives of the equipment used in the following examples are provided in order to facilitate the illustrations – to understand how such economic (average service) lives are determined, see Lesson 5: Determining the Economic Life / Average Service Life of Equipment and Fixtures.

Demonstration of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Commercial Equipment

The following is a step-by-step demonstration of how to determine and use a Maximum Index Factor, relative to the index factors found in Table 1: Commercial Equipment Index Factors, of AH 581:

- Ascertain the type of equipment and its acquisition cost and year.

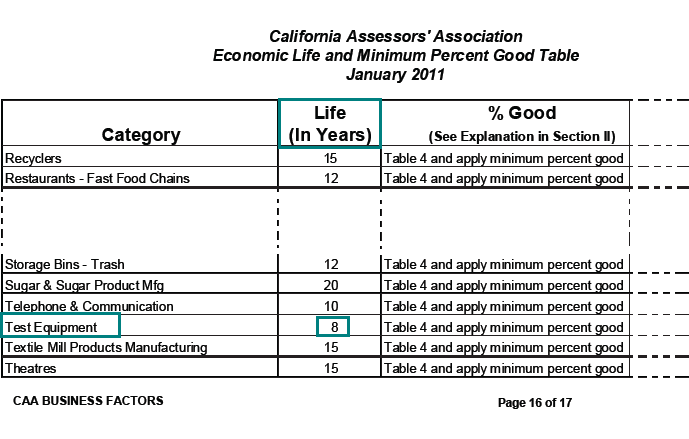

In 1999, a business acquired test equipment at a cost of $800,000. - Determine the economic life (average service life) for the type of equipment being valued via a review of the economic lives for equipment and fixtures published by the California Assessors' Association, as described in Lesson 5; and provided here:

Test Equipment = 8 years

- Calculate the Maximum Index Factor Age for the equipment by multiplying its economic life by 125 percent. Equipment Economic Life (years) × 125% = Maximum Index Factor Age (years)* 8 years × 1.25 = 10 years *(rounded to the nearest whole number)

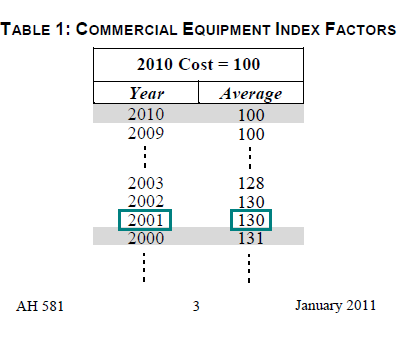

- Calculate the Maximum Index Factor Year for the equipment by subtracting the Maximum Index Factor Age – in years, as calculated in the preceding step – from the lien date year for which the estimate of value is sought. Lien Date Year − Maximum Index Factor Age = Maximum Index Factor Year 2011 − 10 years = 2001 (lien date 2011 chosen for illustrative purposes only)

- Locate the Recommended Maximum Index Factor by finding the “commercial” equipment index factor corresponding to the Maximum Index Factor Year (calculated in the preceding step) using Table 1, Commercial Equipment Index Factors, of AH 581 (2011).

2001 = 130

- Locate the Acquisition Year Index Factor by finding the “commercial” equipment index factor corresponding to the year that the equipment being valued was acquired, using Table 1, Commercial Equipment Index Factors, of AH 581 (2011). 1999 = 134

- Compare the Recommended Maximum Index Factor (found in step 5) to the Acquisition Year Index Factor (found in step 6), and then select the lesser of the two factors. 130 < 134

- Calculate the RCN for the equipment, as of the lien date (January 1, 2011), by multiplying the equipment's acquisition cost by the decimal equivalent of the index factor (percent) found in the preceding step. RCN = $800,000 × 1.30 = $1,040,000 Thus, by employing the use of a maximum index factor (130), the RCN for the equipment is estimated to be $1,040,000, on lien date 2011 (January 1, 2011). If a maximum was not employed, the RCN would have been $1,072,000 ($800,000 × 1.34); an increase of $32,000. To arrive at an estimate of value for the equipment, you would apply a percent good factor to the RCN, as explained in Lesson 3.

Practical Application of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Commercial Equipment

Example 1 – Commercial Equipment:

In 1992, a business acquired office equipment at a cost of $125,000. If the economic life for office equipment is 12 years, what is the recommended maximum index factor for use in valuing this equipment, as of lien date 2011 (January 1); and what is its RCN?

Solution:

Recommended Maximum Index Factor

- Maximum Index Factor Age = Economic Life × 125% (converted to a decimal equivalent)

- Maximum Index Factor Age = 15 years (12 years × 1.25)

- Maximum Index Factor Year = Valuation Lien Date Year − Maximum Index Factor Age

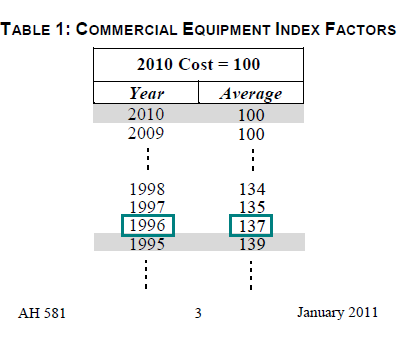

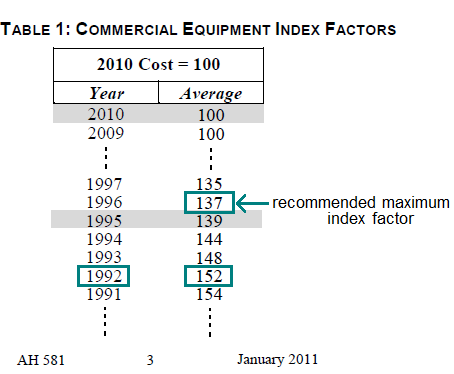

- Maximum Index Factor Year = 1996 (2011 − 15 years)

- Recommended Maximum Index Factor = 137 (Table 1 index factor for 1996)

- Calculate the Maximum Index Factor Age* for the equipment by multiplying its economic life by 125 percent. (Economic life determined to be 12 years based on a review of the CAA tables, as discussed in Lesson 5.) 12 years × 1.25 = 15 years* (rounded to the nearest whole number)

- Calculate the Maximum Index Factor Year for the equipment by subtracting its Maximum Index Factor Age from its valuation lien date year. 2011 − 15 years = 1996

- Locate the Recommended Maximum Index Factor by finding the index factor corresponding to the Maximum Index Factor Year, using 2011 AH 581 Table 1: Commercial Equipment Index Factors.

1996 = 137

RCN

- Acquisition Year Index Factor = 152 (Table 1 index factor for 1992)

- The lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor = 137 < 152

- RCN = Cost × Index Factor (converted to decimal equivalent)

- RCN = $125,000 × 1.37

- RCN = $171,250

- Locate the Acquisition Year Index Factor by finding the index factor corresponding to the year that the equipment being valued was acquired, using 2011 AH 581 Table 1: Commercial Equipment Index Factors.

1992 = 152 - Select the lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor for use in valuing the equipment. 137 < 152

- Calculate the RCN (2011) for the equipment, by multiplying the acquisition cost of the equipment by the decimal equivalent of the index factor selected in the preceding step.

RCN = $125,000 × 1.37 = $171,250

Demonstration of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Industrial Equipment

The following is a step-by-step demonstration of how to determine and use a Maximum Index Factor, relative to the index factors found in Table 2: Industrial Equipment Index Factors, of AH 581:

- Ascertain the type of equipment and its acquisition cost and year. In 1995, an electronic equipment manufacturer acquired additional manufacturing equipment at a cost of $3,450,000.

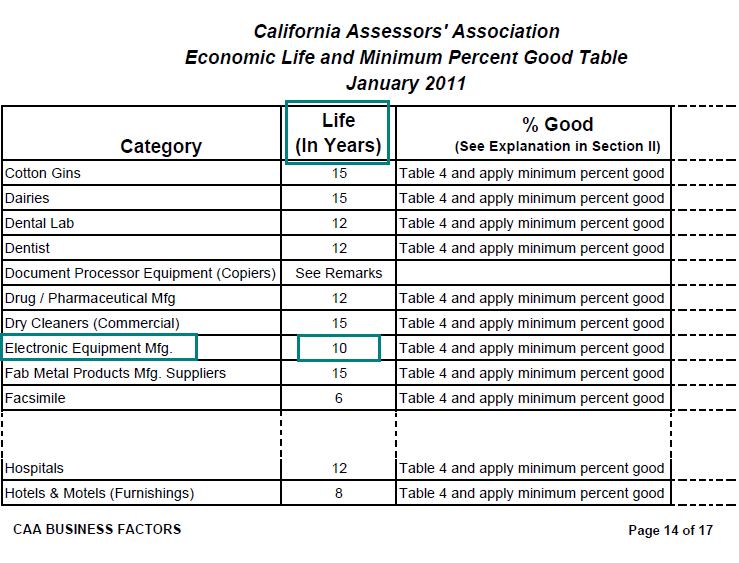

- Determine the economic life (average service life) for the type of equipment being valued via a review of the economic lives for equipment and fixtures published by the California Assessors' Association, as described in Lesson 5; and provided here:

Electronic Equipment Manufacturing = 10 years

- Calculate the Maximum Index Factor Age for the equipment by multiplying its economic life by 125 percent. Equipment Economic Life (years) × 125% = Maximum Index Factor Age (years)* 10 years × 1.25 = 13 years *(rounded to the nearest whole number)

- Calculate the Maximum Index Factor Year for the equipment by subtracting the Maximum Index Factor Age – in years, as calculated in the preceding step – from the lien date year for which the estimate of value is sought. Lien Date Year − Maximum Index Factor Age = Maximum Index Factor Year 2011 − 13 years = 1998 (lien date 2011 chosen for illustrative purposes only)

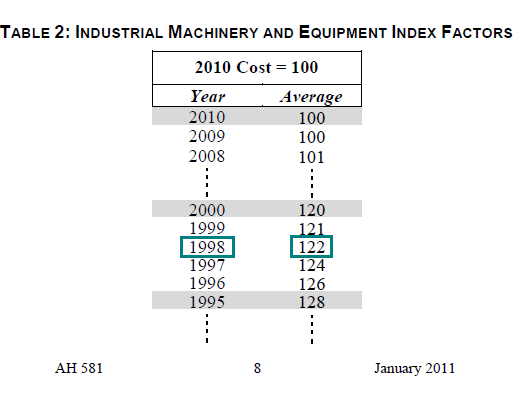

- Locate the Recommended Maximum Index Factor by finding the “industrial” equipment index factor corresponding to the Maximum Index Factor Year (calculated in the preceding step) using Table 2: Industrial Equipment Index Factors, of AH 581 (2011).

1998 = 122

- Locate the Acquisition Year Index Factor by finding the index factor corresponding to the year that the equipment being valued was acquired, using Table 2: Industrial Equipment Index Factors, of AH 581 (2011). 1995 = 128

- Compare the Recommended Maximum Index Factor (found in step 5) to the Acquisition Year Index Factor (found in step 6), and then select the lesser of the two factors. 122 < 128

- Calculate the RCN for the equipment, as of the valuation lien date (January 1, 2011), by multiplying the equipment's acquisition cost by the decimal equivalent of the index factor (percent) found in the preceding step. RCN = $3,450,000 × 1.22 = $4,209,000 Thus, by employing the use of a maximum index factor (122), the RCN for the equipment is estimated to be $4,209,000, on lien date 2011 (January 1, 2011). If a maximum was not employed, the RCN would have been $4,416,000 ($3,450,000 × 1.28); an increase of $207,000. To arrive at an estimate of value for the equipment, you would apply a percent good factor to the RCN, as explained in Lesson 3.

Practical Application of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Industrial Equipment

Example 1 – Industrial Equipment:

In 1990, a pharmaceutical company acquired drug manufacturing equipment at a cost of $5,000,000. If the economic life for pharmaceutical drug manufacturing equipment is 12 years, what is the recommended maximum index factor for use in valuing this equipment, as of lien date 2011 (January 1); and what is its RCN?

Solution:

Recommended Maximum Index Factor

- Maximum Index Factor Age = Economic Life × 125% (converted to a decimal equivalent)

- Maximum Index Factor Age = 15 years (12 years × 1.25)

- Maximum Index Factor Year = Valuation Lien Date Year − Maximum Index Factor Age

- Maximum Index Factor Year = 1996 (2011 − 15 years)

- Recommended Maximum Index Factor = 126 (Table 2 index factor for 1996)

- Calculate the Maximum Index Factor Age* for the equipment by multiplying its economic life by 125 percent. (Economic life determined to be 12 years based on a review of the CAA tables, as discussed in Lesson 5.) 12 years × 1.25 = 15 years *(rounded to the nearest whole number)

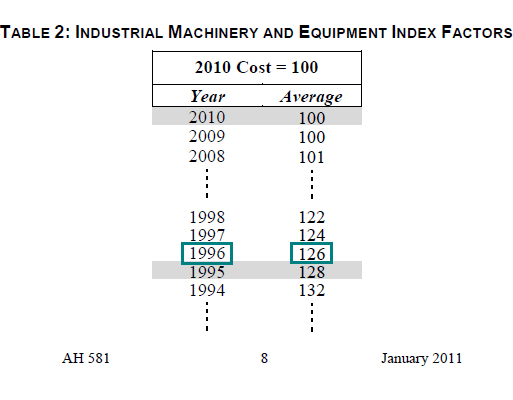

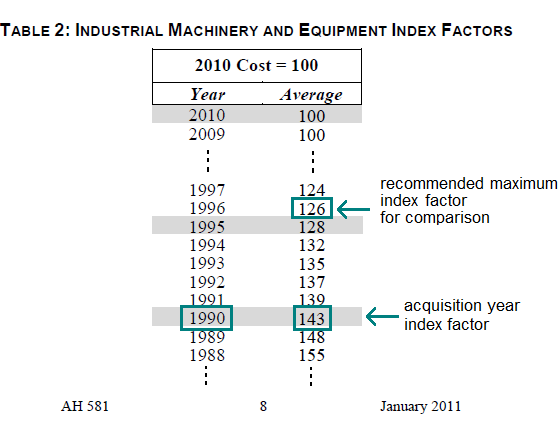

- Calculate the Maximum Index Factor Year for the equipment by subtracting its Maximum Index Factor Age from its valuation lien date year. 2011 − 15 years = 1996

- Locate the Recommended Maximum Index Factor by finding the index factor corresponding to the Maximum Index Factor Year, using 2011 AH 581 Table 2: Industrial Equipment Index Factors.

1996 = 126

RCN

- Acquisition Year Index Factor = 143 (Table 2 index factor for 1990)

- The lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor = 126 < 143

- RCN = Cost × Index Factor (converted to decimal equivalent)

- RCN = $5,000,000 × 1.26

- RCN = $6,300,000

- Locate the Acquisition Year Index Factor by finding the index factor corresponding to the year that the equipment being valued was acquired, using 2011 AH 581 Table 2: Industrial Equipment Index Factors. 1990 = 143

- Select the lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor for use in valuing the equipment. 126 < 143

- Calculate the RCN (2011) for the equipment, by multiplying the acquisition cost of the equipment by the decimal equivalent of the index factor selected in the preceding step.

RCN = $5,000,000 × 1.26 = $6,300,000

Demonstration of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Construction Equipment

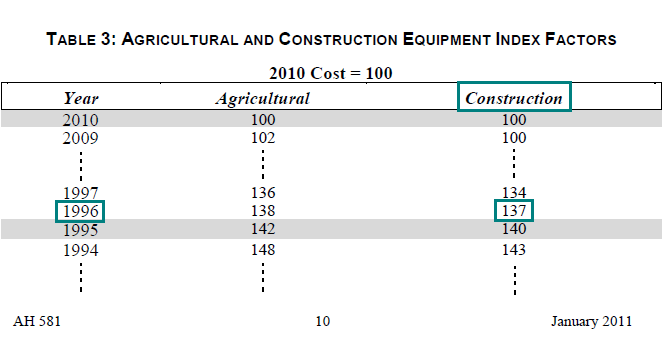

The following is a step-by-step demonstration of how to determine and use a Maximum Index Factor, relative to the “construction” equipment index factors found in Table 3: Agricultural and Construction Equipment Index Factors, of AH 581:

- Ascertain the type of equipment and its acquisition cost and year. In 1992, a construction company acquired non-mobile construction equipment at a cost of $850,000.

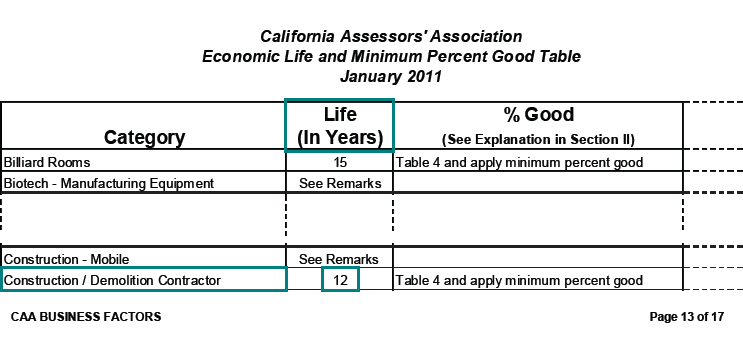

- Determine the economic life (average service life) for the type of equipment being valued via a review of the economic lives for equipment and fixtures published by the California Assessors' Association, as described in Lesson 5; and provided here:

Construction / Demolition Contractor = 12 years

- Calculate the Maximum Index Factor Age for the equipment by multiplying its economic life by 125 percent. Equipment Economic Life (years) × 125% = Maximum Index Factor Age (years)* 12 years × 1.25 = 15 years*(rounded to the nearest whole number)

- Calculate the Maximum Index Factor Year for the equipment by subtracting the Maximum Index Factor Age – in years, as calculated in the preceding step – from the lien date year for which the estimate of value is sought. Lien Date Year − Maximum Index Factor Age = Maximum Index Factor Year 2011 − 15 years = 1996 (lien date 2011 chosen for illustrative purposes only)

- Locate the Recommended Maximum Index Factor by finding the “construction” equipment index factor corresponding to the Maximum Index Factor Year (calculated in the preceding step) using Table 3: Agricultural and Construction Equipment Index Factors, of AH 581 (2011).

1996 = 137

- Locate the Acquisition Year Index Factor by finding the "construction" equipment index factor corresponding to the year that the equipment being valued was acquired, using Table 3: Agricultural and Construction Equipment Index Factors, of AH 581 (2011). 1992 = 148

- Compare the Recommended Maximum Index Factor (found in step 5) to the Acquisition Year Index Factor (found in step 6), and then select the lesser of the two factors. 137 < 148

- Calculate the RCN for the equipment, as of the valuation lien date (January 1, 2011), by multiplying the equipment's acquisition cost by the decimal equivalent of the index factor (percent) found in the preceding step. RCN = $850,000 × 1.37 = $1,164,500 Thus, by employing the use of a maximum index factor (137), the RCN for the equipment is estimated to be $1,164,500, on lien date 2011 (January 1, 2011). If a maximum was not employed, the RCN would have been $1,258,000 ($850,000 × 1.48); an increase of $93,500. To arrive at an estimate of value for the equipment, you would apply a percent good factor to the RCN, as explained in Lesson 3.

Practical Application of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Construction Equipment

Example 1 – Construction Equipment:

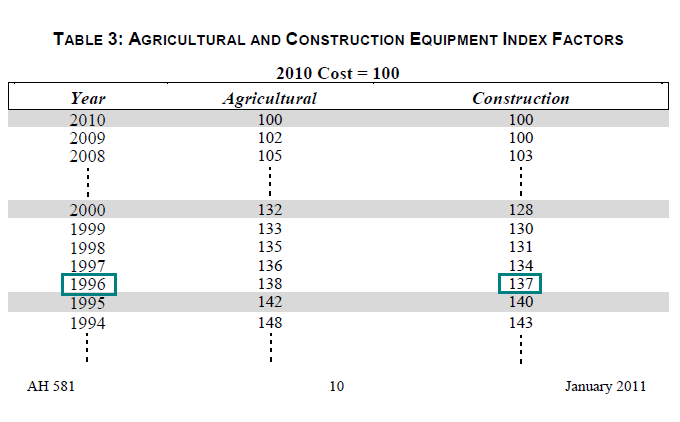

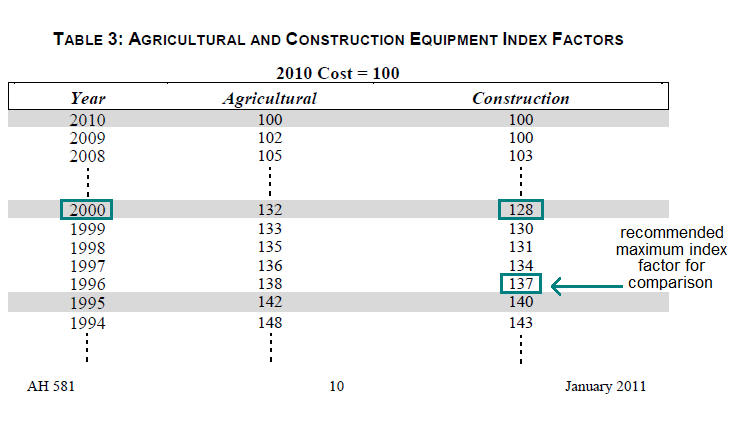

In 2000, a construction company acquired a tower crane at a cost of $1,250,000. If the economic life for non-mobile construction equipment is 12 years, what is the recommended maximum index factor for use in valuing this equipment, as of lien date 2011 (January 1); and what is its RCN?

Solution:

Recommended Maximum Index Factor

- Maximum Index Factor Age = Economic Life × 125% (converted to a decimal equivalent)

- Maximum Index Factor Age = 15 years (12 years × 1.25)

- Maximum Index Factor Year = Valuation Lien Date Year − Maximum Index Factor Age

- Maximum Index Factor Year = 1996 (2011 − 15 years)

- Recommended Maximum Equipment Index Factor = 137 (Table 3 construction index factor for 1996)

- Calculate the Maximum Index Factor Age* for the equipment by multiplying its economic life by 125 percent. (Economic life determined to be 12 years based on a review of the CAA tables, as discussed in Lesson 5.) 12 years × 1.25 = 15 years *(rounded to the nearest whole number)

- Calculate the Maximum Index Factor Year for the equipment by subtracting its Maximum Index Factor Age from its valuation lien date year. 2011 − 15 years = 1996

- Locate the Recommended Maximum Index Factor by finding the index factor corresponding to the Maximum Index Factor Year, using 2011 AH 581 Table 3: Agricultural and Construction Equipment Index Factors.

1996 = 137

RCN

- Acquisition Year Index Factor = 128 (Table 3 index factor for 2000)

- The lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor = 128 < 137

- RCN = Cost × Index Factor (converted to decimal equivalent)

- RCN = $1,250,000 × 1.28

- RCN = $1,600,000

- Locate the Acquisition Year Index Factor by finding the index factor corresponding to the year that the equipment being valued was acquired, using 201 AH 581 Table 3: Agricultural and Construction Equipment Index Factors. 2000 = 128

- Select the lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor for use in valuing the equipment. 128 < 137

- Calculate the RCN (2011) for the equipment, by multiplying the acquisition cost of the equipment by the decimal equivalent of the index factor selected in the preceding step.

RCN = $1,250,000 × 1.28 = $1,600,000

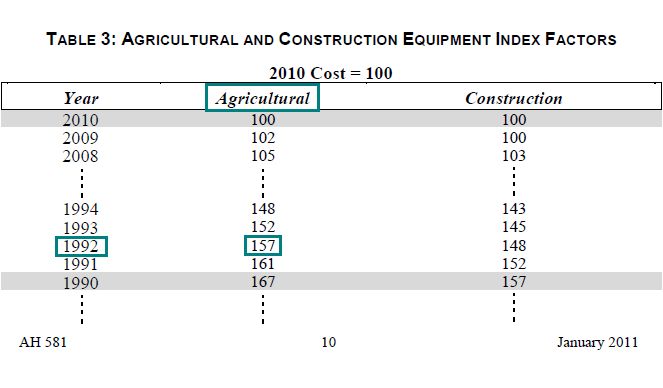

Demonstration of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Agricultural Equipment

The following is a step-by-step demonstration of how to determine and use a Maximum Index Factor, relative to the “agricultural” equipment index factors found in Table 3: Agricultural and Construction Equipment Index Factors, of AH 581:

- Ascertain the type of equipment and its acquisition cost and year. In 1990, a dairy farm acquired dairy equipment at a cost of $340,000.

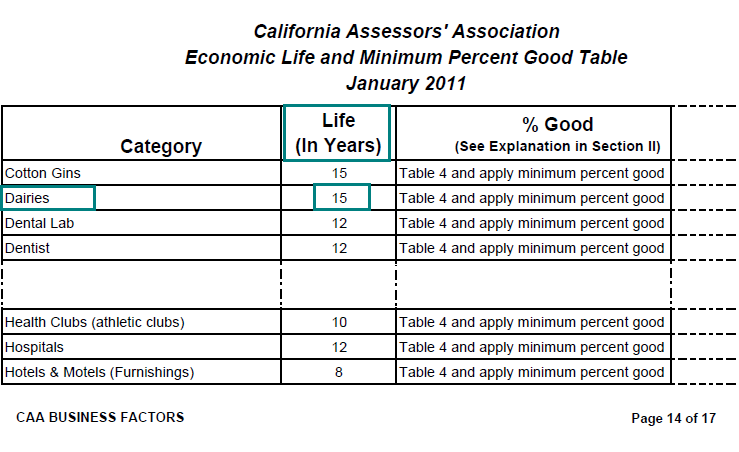

- Determine the economic life (average service life) for the type of equipment being valued via a review of the economic lives for equipment and fixtures published by the California Assessors' Association, as described in Lesson 5; and provided here:

Dairies = 15 years

- Calculate the Maximum Index Factor Age for the equipment by multiplying its economic life by 125 percent. Equipment Economic Life (years) × 125% = Maximum Index Factor Age (years)* 15 years × 1.25 = 19 years *(rounded to the nearest whole number)

- Calculate the Maximum Index Factor Year for the equipment by subtracting the Maximum Index Factor Age – in years, as calculated in the preceding step – from the lien date year for which the estimate of value is sought. Lien Date Year − Maximum Index Factor Age = Maximum Index Factor Year 2011 − 19 years = 1992 (lien date 2011 chosen for illustrative purposes only)

- Locate the Recommended Maximum Index Factor by finding the “agricultural” equipment index factor corresponding to the Maximum Index Factor Year (calculated in the preceding step) using Table 3: Agricultural and Construction Equipment Index Factors, of AH 581 (2011).

1992 = 157

- Locate the Acquisition Year Index Factor by finding the “agricultural” equipment index factor corresponding to the year that the equipment being valued was acquired, using Table 3: Agricultural and Construction Equipment Index Factors, of AH 581 (2011). 1990 = 167

- Compare the Recommended Maximum Index Factor (found in step 5) to the Acquisition Year Index Factor (found in step 6), and then select the lesser of the two factors. 157 < 167

- Calculate the RCN for the equipment, as of the valuation lien date (January 1, 2011), by multiplying the equipment's acquisition cost by the decimal equivalent of the index factor (percent) found in the preceding step. RCN = $340,000 × 1.57 = $533,800 Thus, by employing the use of a maximum index factor (157), the RCN for the equipment is estimated to be $533,800, on lien date 2011 (January 1, 2011). If a maximum was not employed, the RCN would have been $567,800 ($340,000 × 1.67); an increase of $34,000. To arrive at an estimate of value for the equipment, you would apply a percent good factor to the RCN, as explained in Lesson 3.

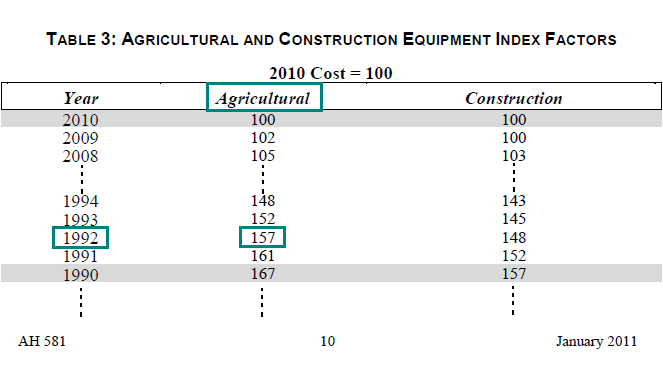

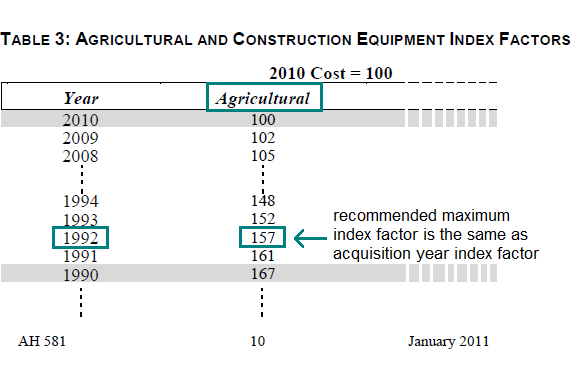

Practical Application of Determining and Using a Recommended Maximum Index Factor in the Calculation of RCN for Agricultural Equipment

Example 1 – Agricultural Equipment:

In 1992, a cotton farm acquired 6 cotton gins at a cost of $300,000. If the economic life for cotton gins is 15 years, what is the recommended maximum index factor for use in valuing this equipment, as of lien date 2011 (January 1) ); and what is its RCN?

Solution:

Recommended Maximum Index Factor

- Maximum Index Factor Age = Economic Life × 125% (converted to a decimal equivalent)

- Maximum Index Factor Age = 19 years (15 years × 1.25)

- Maximum Index Factor Year = Valuation Lien Date Year − Maximum Index Factor Age

- Maximum Index Factor Year = 1992 (2011 − 19 years)

- Recommended Maximum Equipment Index Factor = 157 (Table 3 agricultural index factor for 1992

- Calculate the Maximum Index Factor Age* for the equipment by multiplying its economic life by 125 percent. (Economic life determined to be 12 years based on a review of the CAA tables, as discussed in Lesson 5.) 15 years × 1.25 = 19 years *(rounded to the nearest whole number)

- Calculate the Maximum Index Factor Year for the equipment by subtracting its Maximum Index Factor Age from its valuation lien date year. 2011 − 19 years = 1992

- Locate the Recommended Maximum Index Factor by finding the index factor corresponding to the Maximum Index Factor Year, using 2011 AH 581 Table 3: Agricultural and Construction Equipment Index Factors.

1992 = 157

RCN

- Acquisition Year Index Factor = 157 (Table 3 index factor for 1992)

- The lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor = 157 = 157

- RCN = Cost × Index Factor (converted to decimal equivalent)

- RCN = $300,000 × 1.57

- RCN = $471,000

- Locate the Acquisition Year Index Factor by finding the index factor corresponding to the year that the equipment being valued was acquired, using 2011 AH 581 Table 3: Agricultural and Construction Equipment Index Factors. 1992 = 157

- Select the lesser of the Recommended Maximum Index Factor and the Acquisition Year Index Factor for use in valuing the equipment. 157 = 157

- Calculate the RCN (2011) for the equipment, by multiplying the acquisition cost of the equipment by the decimal equivalent of the index factor selected in the preceding step.

RCN = $300,000 × 1.57 = $471,000

Lesson Summary

The lesson you just read on the application of Recommended Maximum Index Factors, demonstrates how to determine such factors and arrive at estimates of RCN, using recommended maximum index factors, in lieu of acquisition year index factors. Owing to rapid technological changes, which have taken place in recent years, it is recommended that a maximum equipment index factor be used in valuing equipment when the age of the equipment exceeds the economic life for that type of equipment by 25% or more. The recommended maximum equipment index factor is the factor corresponding to equipment of an age equal to 125% of the economic life of such equipment, rounded to the nearest whole year. Selection of the applicable index factor is then based on choosing the lesser of the recommended maximum index factor or the acquisition year index factor.

Note: Before proceeding on to the next lesson, be sure to complete the exercises for this lesson.