Board of Equalization Announces Increase in Statewide Assessed Property Values

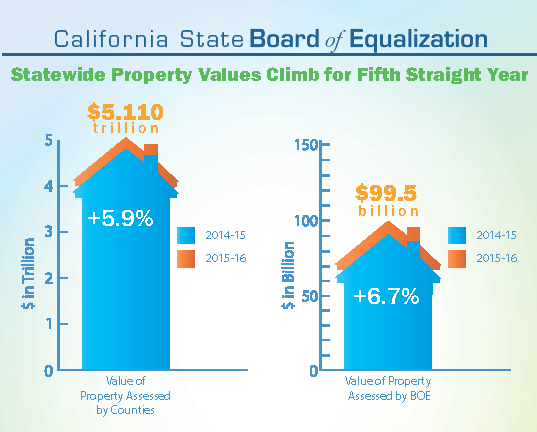

Sacramento – California State Board of Equalization (BOE) Chairman Jerome E. Horton, Vice Chair George Runner, Board Member Fiona Ma, and Board Member Diane Harkey announced that statewide, assessed property values rose by 5.9 percent in 2015-16.

County assessors are responsible for assessing the value of each home, as well as other residential and commercial property as of January 1 of each year. That value is used to set the property tax bill that is due in December of that year, and April of the coming year. The BOE is responsible for assessing properties such as public utilities and railroads. Those annual tax bills are set based on these valuations.

This is the fifth consecutive year the total value of California's county and state-assessed properties has increased, fueled in large part by the recovery in the state's housing market. For 2015-16, values rose to $5.209 trillion, an increase of $289.9 billion (5.9 percent) from 2014-15. Values statewide are 14.4 percent higher than they were in 2008-09.

Fifty-six counties posted year-to-year increases in assessed value, most of those increases above two percent. Two counties experienced a year-to-year decline in value. Thirty-three counties grew in excess of five percent.

The assessed valuation in California's 15 coastal counties, which accounts for more than 60 percent of total assessed valuation, gained 6.0 percent. Valuations in the 43 inland counties rose 5.8 percent.

Assessed property values in the following regions: