Lesson 6: Present Worth of $1 Per Period

Check Your Knowledge

In order to solve the following problems you will need to refer to AH 505 to look up the factors in the compound interest tables. Before you start, please print the problems using the "Print Questions" button below so you can work through the problems on your own. After you work through the problem, the solution can be viewed by clicking on the blue plus sign immediately following the question. Additionally, when you have completed all the problems, you may print all of the solutions using the "Print Questions with Answers" button below.

Problem 1

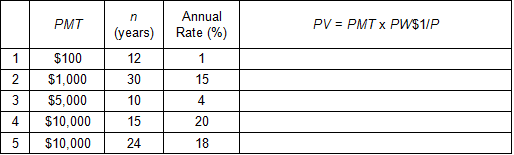

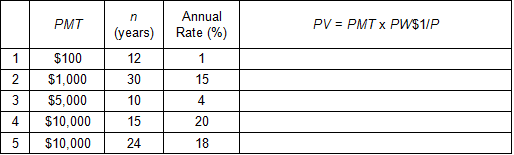

Solve for present value using the correct PW$1/P factor:

Solution

Solution:

To solve, calculate the present value of each payment amount by multiplying the amount by the PW$1/P factor, found in the AH 505 annual compound interest tables, for the given interest rate and term:

PV = PMT × PW$1/P

PV = $100 × 11.255077 (AH 505, page 13, column 5)

PV = $1,125.51

PV = PMT × PW$1/P

PV = $1,000 × 6.565980 (AH 505, page 69, column 5)

PV = $6,565.98

PV = PMT × PW$1/P

PV = $5,000 × 8.110896 (AH 505, page 25, column 5)

PV = $40,554.48

PV = PMT × PW$1/P

PV = $10,000 × 4.675473 (AH 505, page 89, column 5)

PV = $46,754.73

PV = PMT × PW$1/P

PV = $10,000 × 5.450949 (AH 505, page 81, column 5)

PV = $54,509.49

Problem 2

Jim took out a standard 30-year mortgage loan for $200,000 with monthly payments of $1,199.10; interest rate of 6%.

Eight years later, he sold the house. What was the remaining balance on the loan when he sold?

(Hint: At any point in time, the remaining balance on an amortizing mortgage loan is equal to the present value of the

remaining loan payments discounted at the contract rate of interest.)

Solution

Solution:

There would have been 22 years of monthly payments remaining when the house was sold.

To solve, calculate the remaining balance of the loan using the PW$1/P factors in the monthly compound interest tables of AH 505.

Multiply the payment amount by the PW$1/P factor for the contract interest rate of 6% for a 22 year term.

PV = PMT × PW$1/P (6%, 22 yrs, monthly)

PV = $1,199.10 × 146.396927 (AH 505, page 32, column 5)

PV = $175,544.56

Jim´s remaining loan balance was $175,544.56.

Problem 3

When the contract rent under a lease is less than the market rent, there is a leasehold advantage in favor of the tenant.

This is sometimes called the "bonus value" in the lease. If a tenant is able to freely assign or sublease his interest to another tenant,

he may be able to capture the bonus value. The annual contract rent for a property is $180,000; the annual market rent is $225,000.

There are 5 years remaining in the lease. What is the estimated bonus value in the lease? Assume an annual interest (discount) rate of 5%.

(Hint: Bonus value can be estimated by discounting the difference between the market and contract rent over the remaining term of the lease.)

Solution

Solution:

To solve, calculate the present value of the difference between the market and contract rent, $45,000,

over the remaining term of the lease using the annual PW$1/P factor found in the annual compound interest tables of AH 505.

Multiply the payment amount (the difference between market and contract rent) using the PW$1/P factor for the interest rate of 5% for a 5 year term.

PV = PMT × PW$1/P (5%, 5 yrs, annual)

PV = $45,000 × 4.329477 (AH 505, page 29, column 5)

PV = $194,826.47

The estimated bonus value is $194,826.47.

Problem 4

An income property generates an expected annual net income of $1,250,000; this income is expected to remain level over an expected 8-year holding period. The estimated value of the property at the end of the holding period -- its reversionary value -- is $12,500,000. Assuming an interest (discount) rate of 12%, estimate the value of the property using discounted cash flow (DCF) analysis. (Hint: The essence of DCF analysis is that a property´s value is equal to the present value of the property´s expected market net income over the holding period, plus the present value of the property´s expected reversionary value at the end of the holding period, with the income discounted at a yield rate, or expected rate of return, required by market participants.)

Solution

Solution:

To estimate the property´s value, calculate:

- the present value of the property´s estimated annual net income over the 8-year holding period, and

- the present value of its estimated future reversionary value at the end of the holding period. The estimated value of the property is the sum these two present values.

Calculate the present value of the property´s estimated net income by multiplying the expected annual net income by the PW$1/P factor in the AH 505 annual compound interest tables for an interest rate of 12% for the expected holding period of 8 years.

PV = PMT × PW$1/P (12%, 8 yrs, annual)

PV = $1,250,000 × 4.967640 (AH 505, page 57, column 5)

PV = $6,209,550.00

Calculate the present value of the property´s estimated reversionary value by multiplying the reversionary value by the PW$1 factor for the interest rate of 12% for an 8 year term.

PV = FV × PW$1 (12%, 8 yrs, annual)

PV = $12,500,000 × 0.403883 (AH 505, page 57, column 4)

PV = $5,048,538.50

The estimated value of the property is the sum of the two present values.

Total PV = PV (annual net income) + PV (reversion)

Total PV = $6,209,550.00 + $5,048,538.50 = $11,258,087.50, say $11,258,000

Problem 5

Mary will retire in 20 years and after she retires she wants to be able to withdraw $10,000 at the end of each year for 10 years from her retirement account.

How much should she invest in equal annual deposits over the next 20 years to fund her retirement account?

Assume that her first deposit occurs a year from today and that the annual interest rate throughout is 9%.

Solution

Solution:

This exercise combines the use of the PW$1/P factor and the SFF.

First, calculate the lump sum that Mary will need in her account upon retirement to fund her desired withdrawals.

Second, calculate how much she must set aside each year in order to have that lump sum upon retirement.

Calculate the lump sum needed upon retirement by multiplying the amount Mary wishes to withdraw each year using the PW$1/P factor.

PV = PMT × PW$1/P (9%, 10 yrs, annual)

PV = $10,000 × 6.417658 (AH 505, page 45, column 5)

PV = $64,176.58

Calculate the period payment necessary to reach the lump sum using the SFF. The PV above becomes the FV here.

PMT = FV × SFF (9%, 20 yrs, annual)

PMT = $64,177 × 0.019546 (AH 505, page 45, column 3)

PMT = $1,254.40

She should deposit $1,254.40 at the end of each year for the next 20 years.

Problem 6

A taxable possessory interest (TPI) involves the private use of publicly-owned property. Under certain conditions,

the right to possession held by a private possessor is taxable, even though the underlying fee interest held by the public owner is exempt.

One way of valuing a taxable possessory interest is called the income approach – direct method.

In this method, the estimated value of the TPI is equal to the present value of the expected net market rent to the

public owner over the possessor´s reasonably anticipated term of possession (in essence, the duration of the TPI).

Suppose that a private possessor leases government-owned land. The net market rent is $12,000 per year.

The reasonably anticipated term of possession is 20 years. Using an interest (discount) rate of 10%, estimate the value of the

TPI using the income approach – direct method.

Solution

Solution:

To estimate the value of the TPI, we need to determine the present value of the net market rent to the public owner.

Calculate this value by multiplying the net market rent by the PW$1/P factor for interest rate of 10% and a 20 year term.

PV = PMT × PW$1/P (10%, 20 yrs, annual)

PV = $12,000 × 8.513564 (AH 505, page 49, column 5)

PV = $102,162.77

The estimated value of the TPI is $102,162.77.